When you’ve been investing long enough, you develop a certain resilience and respect for the volatility of the markets as they swing between periods of fear and euphoria. The day to day swings make for anxious moments, but should rarely (if ever) represent the justification for making any long-term investment decisions. Today, we are faced with the fact that the predicted military conflict between Russia and the Ukraine has become a reality.

Before we go into the investment analysis, I wanted to share this first: given all of the challenges we have faced globally over the last two years, it is supremely disappointing to see history repeating itself in Eastern Europe. While we are going to focus on the investment implications and speak in terms of data and markets—as that is our area of expertise—we’d be remiss to not acknowledge that there is a very human cost that we will sadly be overlooking. What’s lost in the talks of valuations, downside risk, and the like is the loss of life, loss of livelihood and the displacement that seems inevitable as this hostility plays out.

But I’ll descend from the soap box—as solving that existential question is not one I’m qualified to do—and will focus on the things we know best: assessing the current situation, evaluating the potential impacts and providing you with our best advice on how to navigate this environment.

Adding Fuel to the Fire

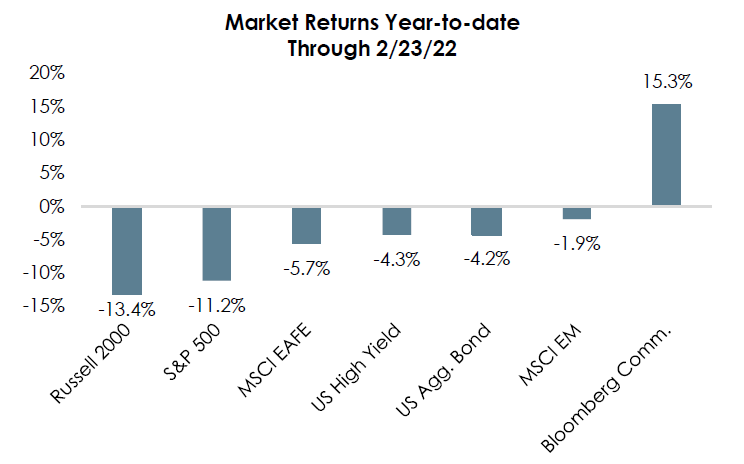

Prior to the rising tensions in Eastern Europe, global markets were already finding themselves trying to reconcile the balancing act of rising inflation, tightening monetary policy, elevated valuations and a global economy that is re-opening and seeing a surge in demand. The combination of the anticipated invasion of Ukraine with persistently high inflation readings (and its implications on Fed policy) has been weighing on the markets. As the chart below indicates, growth oriented stocks and fixed income markets were both seeing declines to start the year, with the one material outlier being commodities which have benefited from rising energy prices.

Source: ACG Research, Bloomberg

Tactical Implications of Russia’s Invasion

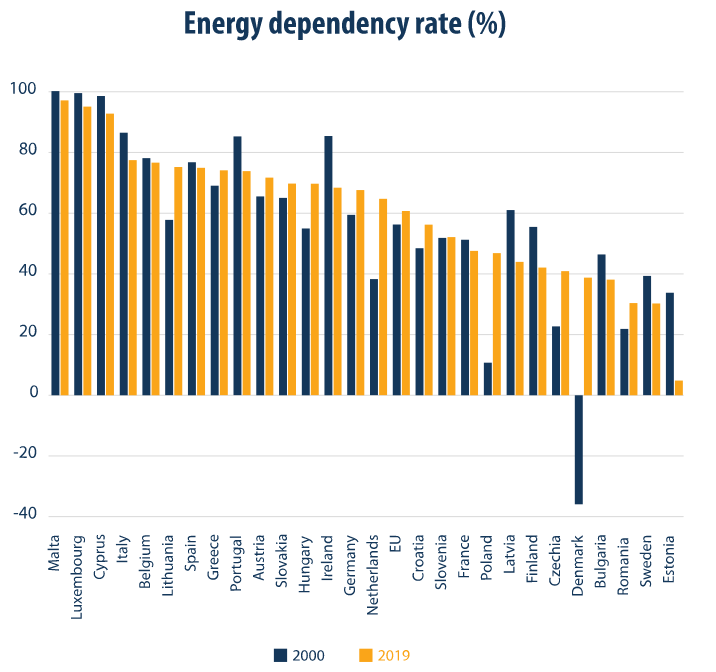

As we’ve seen play out, geopolitical tensions tend to result in an immediate flight to quality and a rise in oil prices. The latter has also been more pronounced due to Russia’s role in the global fossil fuel supply chain, which is where we see one of the near-term implications. Russia’s real leverage and economic impact would seem to be felt most directly in the energy markets and specifically in Western Europe where their reliance on Russia’s crude oil and natural gas is most pronounced. Eurostat estimated in 2019 that Russia supplied Europe with 27% of their crude oil and 41% of their natural gas. Further, as the chart below from Eurostat indicates, Europe’s relative lack of energy independence–with over 60% of its energy demand being supplied via imports—makes it particularly susceptible to supply chain shocks.

Source: Eurostat

The implications for the US would seem to be more subdued. The Office of the United States Trade Representative estimates that Russia is the US’s 26th largest trading partner—in other words we are not heavily reliant on Russia for domestic consumption. In addition, the uncertainty resulting from the conflict could provide cover for the Federal Reserve to be more restrained in their rate increases—which would be a welcomed respite for bond investors. One major unknown for all investors, however, will remain the nature and evolution of sanctions levied on and by Russia. What’s left to be seen is whether the relief rally that closed the day yesterday will prove warranted, or whether retaliatory or further escalation of sanctions follow.

Extending from Tactical to Strategic Horizons

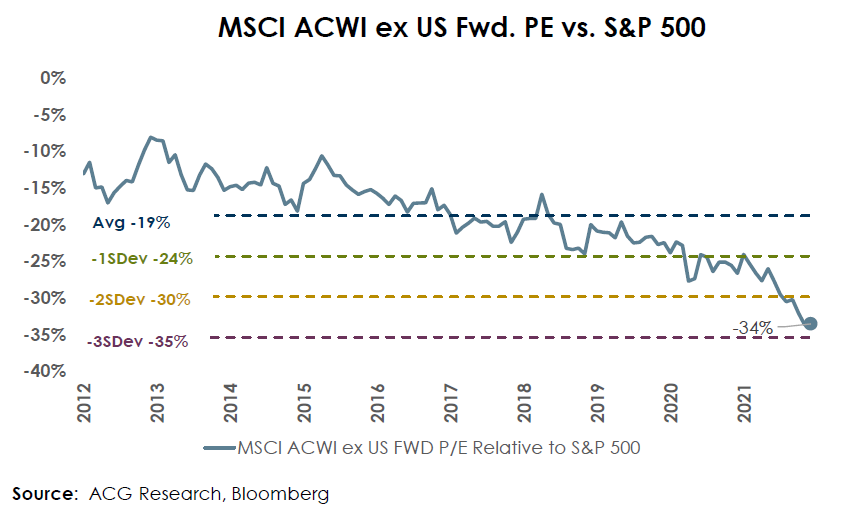

While the circumstances in Eastern Europe would seem to create the most direct risk to Western Europe, it could also present a relatively interesting buying opportunity for long-term investors. From a pricing perspective, Non-US stocks continue to trade at a material discount to US stocks. As the chart below indicates, the valuation discount has reached levels that are statistically very rare.

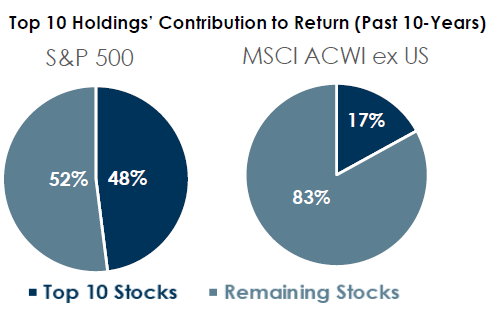

In addition, as we have seen play out already this year, the prospect of rising interest rates has seemed to weigh more heavily on growth oriented stocks—namely those within the technology sector as the Nasdaq was on the brink of its first bear market in two years as of Wednesday’s close. One of the trends that we have seen over the last decade has been the degree to which the Technology concentration in the S&P 500 Index has been a factor in the relative outperformance of US vs. non-US stocks. The chart below shows the degree to which the top ten holdings in the S&P 500 Index (most of which are technology or technology oriented names—Apple, Amazon, Microsoft, Alphabet, Meta) have contributed to returns over the last 10 years.

The bottom line is that—while it comes with some material short-term risk—we could be starting to see the reversion of the trend in outperformance of US stocks vs. Non-US stocks and reviewing your allocation to non-US stocks relative to targets would seem like a prudent first step.

Investment Strategy Implications

No surprise here, but we’re not advocating making any material shifts due to the latest headline on our newsfeed. We do believe that the degree to which the war in Ukraine remains contained will directly impact the risk of a recession and the resilience of the global economy will be tested. These kinds of ill-conceived maneuvers can end up tipping the world into a recession if certain dominos begin to fall, so we remain vigilant. As a result, we think that the two pronged approach detailed below makes the most sense:

- Maintain Lifestyle Liquidity – We continue to advocate holding higher levels of cash in order to meet lifestyle spending needs over the next 12 months to avoid having to raise cash at inopportune times. We have maintained this perspective since before the pandemic and continue to believe it is warranted. In addition, we have been comfortable funding some of this excess cash from fixed income—specifically core fixed income—as a reflection of the limited premium investor have been receiving to extend outward on the yield curve.

- Stay within Strategic Target Allocation Bands – Portfolio allocations naturally fluctuate within ranges as a product of the daily moves in the respective asset classes. While we advocate for maintaining a focus on long-term strategic allocation targets, we do not unnecessarily rebalance (and generate taxes) if the allocations remain within a reasonable range of their targets. When we experience significant market events such as the ones we are currently experiencing, we can start to see portfolios drift outside of their tolerance ranges and our recommendation will be to remain disciplined and rebalance. To be clear, this may imply buying into Non-US equities first, which we appreciate will feel anything but comfortable given the environment. However, maintaining that discipline is one of the best ways to take advantage of the market’s swings between fear and greed.

While the implications above could appear limited, we believe they reflect the discipline that our families expect from us in helping them navigate these uncertain times. In addition, it is worth noting that in many asset classes, we select fund managers whose objective is to apply a discerning eye to the broad universe of investments available to them and select the targeted list of companies, debt instruments and real estate properties that attempt to offer the best risk-adjusted return potential. We believe that those two layers of discipline and focus provides us with the best opportunity to weather these periods of volatility and achieve our client’s long-term goals.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.