As we step into the new year, it’s natural to pause and reflect on the road behind us while considering what lies ahead. For investors, this moment often brings a flood of market predictions, an annual tradition as enduring as it is flawed. Rather than attempting to predict the unpredictable, our aim is to explore the economic trends, policy shifts and market forces likely to shape the 2025 economic outlook for investors in the months ahead. By focusing on the broader dynamics at play, we hope to provide context and clarity in navigating an inherently uncertain environment. For comparison, check out our 4Q investment blog here.

2025 Economic Outlook

All things considered, the US economy enters 2025 on relatively solid footing, having absorbed inflation and the ensuing monetary policy tightening. Based on data collected by the Bureau of Economic Analysis and the Atlanta Fed’s GDPNow estimate for Q4, U.S. gross domestic product is expected to have grown by approximately 2.6% in 2024. Consumption, the largest driver of economic growth in the US, is estimated to have grown by 2.9% on an inflation-adjusted basis, nicely ahead of the 15-year average of 2.5%. Supporting that consumption growth has been above average wage increases enabled by a strong labor market. Job growth in December surprised to the upside and the unemployment rate dropped to 4.1% according to the Bureau of Labor Statistics. Further, the inflation data released this week by the Bureau of Labor Statistics was encouraging, though we continue to believe that the combination of solid economic growth and a competitive labor market will produce inflation that will not allow the Fed to ease rates aggressively.

All of this economic data, however, is backward-looking and we all know the rearview mirror is not a reliable window into the road ahead. It is unknown risks that end up making the difference, of which there are plenty, many of them hinging on policy decisions. Speculation is rampant regarding the risks and opportunities that could be created by tariffs, deregulation or immigration policies. It is only natural to ask ourselves – what should we be doing to take advantage of or hedge ourselves against these decisions?

One concept that I think is worth naming at times like these is the difference between possibilities and probabilities. Both refer to the potential for something to happen. However, possibility means that something could occur, while probability refers to the likelihood that something will occur. As investors, we have to find the balance between the curiosity to consider the range of possibilities, while having the discipline to only act based on probabilities.

One example of this in practice is what we have been seeing from our equity managers amidst the discussions surrounding tariffs and deregulation. Our managers are not unilaterally moving into the re-shoring or friend-shoring trade that could possibly benefit from a more significant tariff regime. Instead, they are looking at management teams that have adeptly managed the recent environment and taken steps to diversify and defend their supply chains because that approach offers them the best probability of being able to weather the uncertainty of tariffs.

Outside the U.S. the economic picture varies, but on the balance we would argue that it is generally less favorable. China has committed to significant monetary and fiscal measures to stimulate the world’s second-largest economy. According to the European Central Bank, real GDP is expected to have grown by just 0.7% in 2024 – which helps justify why they have been more aggressive in their rate-cutting cycle so far than their U.S. counterparts at the Federal Reserve. This has several implications, not the least of which has been the rally in the U.S. dollar, which is now only slightly below its two-year high. One key factor remains the war between Russia and Ukraine. With the war about to enter its fourth year, the level of disruption and destruction continues to grow. European energy prices rose modestly this month after the planned shut-down of the Ukrainian pipeline transporting Russian gas to Europe – ending a six-decade-long supply chain. That being said, any end to the conflict could create significant opportunities for companies in Europe. Last year, the World Economic Forum estimated that it would cost $486 billion to rebuild Ukraine. Further, the EU and its Members (and financial institutions) have committed to making over $130 billion available to help in the rebuilding efforts. Needless to say, we continue to hope for an end to the ongoing humanitarian disaster and the opportunity it would provide to begin to rebuild and help those whose lives have been shattered by the conflict.

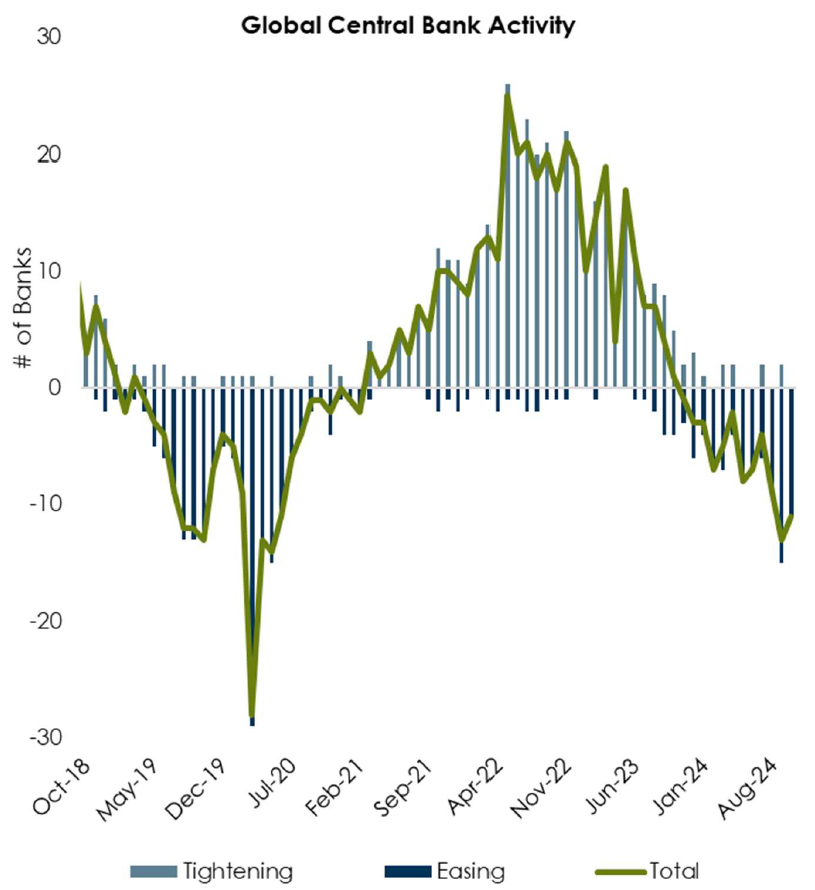

More broadly, we are coming out of several years of relatively coordinated Central Bank action – first in easing and stimulus during COVID, then in tightening as inflation spiked in the aftermath.

As Central Bank action becomes less coordinated, we expect to see continued divergence across the various economies of the world. We believe this creates the opportunity for active managers, particularly outside of the U.S., to generate excess relative returns compared to the broader indices. As always, however, the balancing act becomes how much is that opportunity going to cost us? The answer to that question varies by asset class, which is what we will explore next.

2025 Economic Outlook – Valuations Matter

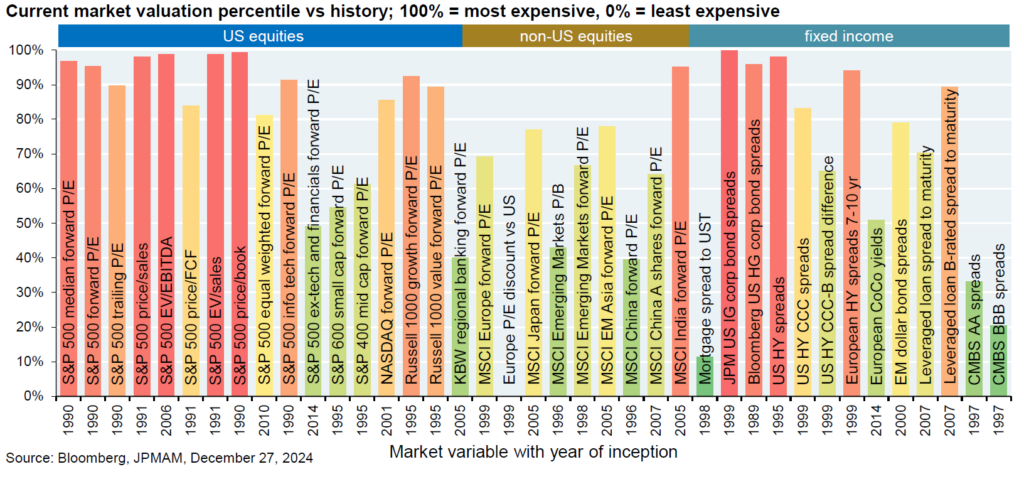

In his most recent memo, Howard Marks of Oaktree lists three guiding principles that he has carried with him throughout his career. The first of which is “It’s not what you buy, it’s what you pay that counts.” In today’s market, it is the prices that investors are being asked to pay that keep us up at night. As the chart below from Michael Cembalest’s recent “Eye on the Market” illustrates, essentially every asset class is trading at above average valuations, the most notable culprit being U.S. Large Cap equities.

Yet high valuations are nothing new. Generally speaking, we’ve been living in a prolonged period of higher-than-average price-to-earnings multiples for almost a decade thanks to a combination of factors. Up until 2022, we had experienced over a decade of low interest rates and excess liquidity. In addition, the growth of the tech (and higher margin) segment of the S&P 500 should drive the average price-to-earnings up for the index relative to long-term history. That said, even compared to recent history, markets are priced almost to perfection, leaving little room for error. According to Factset, the forward 12-month price-to-earnings ratio for the S&P 500 is 21.4x, which is ~10% higher than the 5-year average of 19.7x – and this is with analysts expecting 14.8% growth in earnings for 2025. There’s not a lot of room for error and we think a pause is likely; investors should be ready to see a pullback. Therefore, we see equity markets as a well-priced source of liquidity for those with known cash flow needs in the next 6-12 months or for investors whose equity allocations have grown outside of their targets.

2025 Economic Outlook – Realistic Yields and Optimistic Spreads

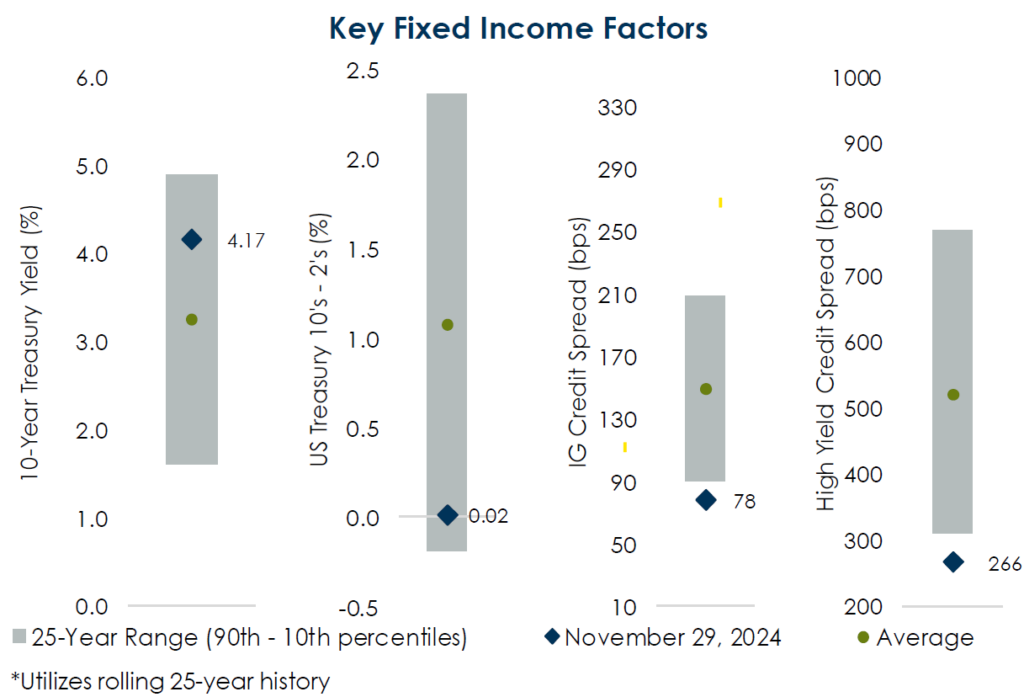

Expensive valuations are not merely an equity market phenomenon. As the chart below highlights, interest rate spreads, both high yield and investment grade, present a similarly Pollyannaish picture.

Since the mid-1990s, the average spread between high yield bonds and U.S. Treasuries has been 530bps – the current spread is 280bps, or about half of the historical average. The last time we spent a prolonged period of time at these levels? You guessed it, during the tech cycle (and bubble) of the late 1990s. We are not comparing the two periods to be alarmists, but we do want to be realistic about what today’s pricing implies for future returns. First, we think that current yield levels finally reflect a realistic view of inflation and the U.S. economic outlook and provide investors with reasonable yields. We do not see aggressive rate cutting ahead, so would temper expectations surrounding returns tied to declining interest rates. Second, we believe that opportunities exist to enhance yield by extending some credit risk but doing so in a highly selective manner.

2025 Economic Outlook – What Actions Should Investors Take?

Proper preparation prevents poor performance. It’s a cliché, but true. We are coming off two years of over 20% returns in the equity markets. Thanks to the research completed by Michael Cembalest’s team at JP Morgan, we know that this has happened only 10 times since 1871. The average annual return over the next 2 years was 6%, though results ranged between -14% and 31% annualized. Our mindset is that investors should be prepared for a pause and a potential pullback in equity markets.

We recommend that investors take this opportunity to evaluate and reconfirm their strategic equity targets and actively rebalance to those targets. This likely involves some measure of profit taking and reduction of equity exposure – particularly within U.S. Equities. For investors who have known cash flows for the next 6-12 months, we are comfortable raising cash at current market levels.

Lastly, we are on the lookout for opportunities, both in the public and private markets. While purchase multiples across the private equity landscape are not cheap, some segments of the market are more attractive than others. We continue to like the opportunity set within the lower middle market and are seeing some interesting opportunities within real estate.

We are long-term optimists and believe in the compounding power of investing alongside great companies. We are currently favoring a more pragmatic outlook, one that acknowledges both the resilience of our economic fundamentals with the elevated prices we are seeing across all asset classes, equity markets in particular. We are focused on what we can control and planning for an admittedly wide range of probabilities. Pre-emptive steps like managing known cash flows and seizing rebalancing opportunities help strengthen your portfolio’s foundation. At the same time, preparing for the unpredictable by maintaining objectivity and a realistically grounded mindset ensures we can respond with confidence when the unexpected inevitably arises.

About Thierry J.D. Brunel

Thierry joined Matter in 2013, bringing years of experience in family office and wealth management. He previously worked in investment research and portfolio management roles at Convergent Wealth Advisors and GenSpring Family Office. At Matter, Thierry leads the investment committee, advising families on portfolio strategy and governance. A Wake Forest University graduate, Thierry has a diverse international background. He’s active in his community, serving as an assistant coach for the John Burroughs School Varsity football team in St. Louis.

Other Blogs by Thierry

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.