Volatility Ahead

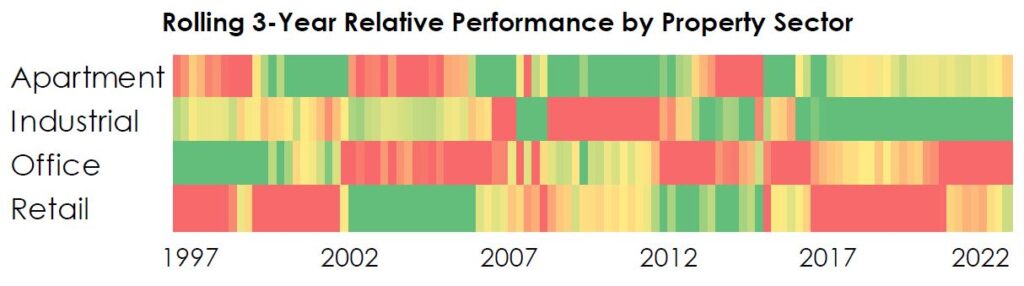

Over the first half of the year, we’ve seen a bifurcation of experiences across our three major asset categories: Equities, Bonds and Real Assets. For equity investors, the story has been the resilience of the economy, the growth of profit margins and the momentum behind AI—evident in Nvidia’s 150%+ return so far in 2024. Fixed income markets have been comparatively volatile due to the moderation of rate cut expectations and the growing consensus surrounding a higher for longer rate narrative. Real Estate continues to muddle through, with experiences varying significantly between sectors and building types, and the turn of the cycle not yet clearly on the horizon. As the chart below highlights, real estate cycles take time to develop and turn, and it would seem unlikely that we’d find capitulation one way or another until there is greater clarity on inflation and interest rates.

It is not always the case, but with the exception of some possible over-exuberance in equity market expectations, we believe current markets (equities, bonds and real estate) are priced relatively appropriately given the set of circumstances we see going forward. More importantly, while the Fed’s current approach might be too “data dependent” and potentially reactive, we would welcome a more measured use of liquidity by central banks following the excesses of the last 15 years.

The Return of the Market Cycle

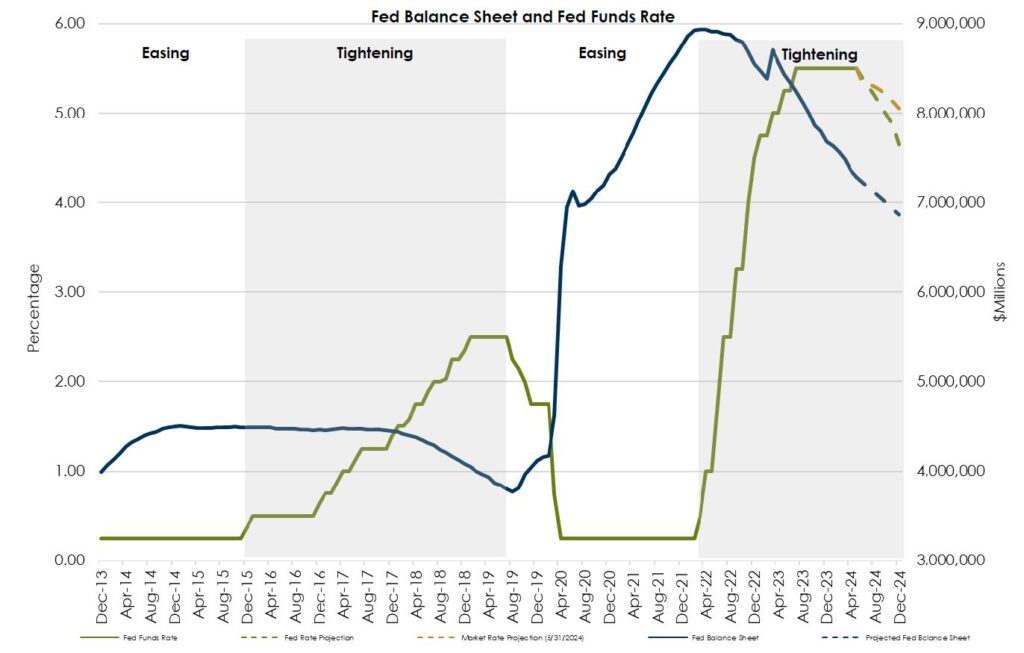

While we could argue that equity markets are potentially overly bullish, based on valuations, growth assumptions and the like, we do think this cycle is proving more typical than others as we have been comforted by the reduction in market intervention by policy makers. The Fed is sticking to its mandate and as the chart below indicates, we are seeing the appropriate reduction in the Fed’s balance sheet. While there is still much work to do, the progress is encouraging.

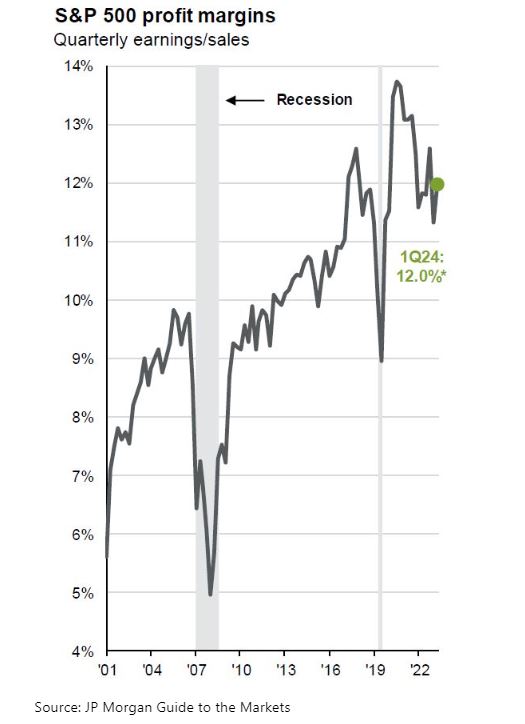

Another positive note has been the degree to which companies have been able to navigate through the fastest rate hiking cycle on record. The chart below highlights the rebound in profit margins across the S&P 500—removing the anomaly of COVID, margins are approaching their prior peak.

Further, despite rising borrowing costs, we have not seen any material increase in charge-offs or defaults. Some of this, no doubt, has to do with the way in which banks are handling the maturation of loans—there is clearly an element of extend and pretend at play. However, banks don’t seem to be sticking their heads in the sand either. According to S&P Global, 14 of the largest 20 banks in the US increased their loan loss reserves in Q4 2023, almost doubling their reserves from the prior year and preparing for a more difficult macro environment. Credit investors are seemingly unfazed, with credit spreads hovering around 200bps below long-term historical averages. All of this points to a financial system that is acting rationally, albeit somewhat optimistically in our opinion.

Where are the cracks?

The relative sense of normalcy is welcome, though there are some risks below the surface that we are monitoring. Given the importance of consumption to US economic growth, any significant risks to the US consumer presents a risk to economic growth. Total credit card debt in the US currently sits above $1.1 Trillion. The two charts below illustrate two important trends. The first is that there are a growing number of accounts for which consumers are opting to only make the minimum payment. The second is that the overall delinquency rate has been climbing (but not spiking) over the last two years.

While they haven’t reached crisis levels, these trends are worth monitoring. The recent softening of spending, evident in the most recent data from the Bureau of Economic Analysis, points to a consumer that may finally be showing signs of fatigue. Further, with inflation in May showing a 2.6% year-over-year change—still firmly above the Fed’s 2% target—and the probability of interest rates remaining higher for longer, our opinion is that the US consumption is likely to weaken further.

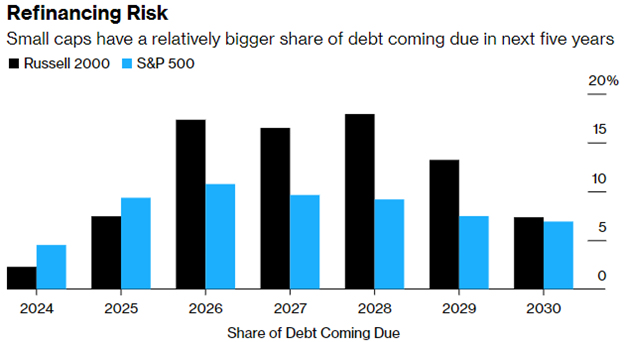

Companies, like consumers, are facing similar dynamics. They are having to contend with higher cost of borrowing, though the impact varies significantly from company to company. Smaller companies would seem to be the most susceptible to the higher for longer trends for two key reasons. The first, as illustrated in the chart below, is their volume of debt maturing in the next 5 years.

The second factor is a structural one. Smaller companies, by virtue of their size and relative risk, tend to have to borrow at shorter maturities—they don’t have the size and strength that afford large companies the option of borrowing at the long end of the yield curve. In a typical, upward sloping yield curve environment, this structural disadvantage is not as visible because it doesn’t directly impact relative cash flows. With an inverted yield curve, however, the higher cost of borrowing on the short-end directly impacts the relative debt service costs. We view this as one of the key contributing factors to why small cap companies remain undervalued relative to their large cap peers and will likely continue to do so until we have clarity on the pace of eventual interest rate cuts.

Portfolio Implications

There’s an inherent polarity to investor psychology and when presented with the current data and information, we can pretty quickly be pulled to being on either the optimistic or pessimistic ends of the spectrum. Our economic outlook would argue for some degree of caution, though our point of views on asset classes should also take into account the specific valuation and risk dynamics within each.

FIXED INCOME

Our expectation for fixed income is that we are likely to see continued volatility in interest rates, with some modest deterioration in credit conditions commensurate with a slowing economy. That said, futures markets that now price in 1-2 rate cuts this year seem much more realistic given the outlook for inflation. Given the inversion of the yield curve, there is not much incentive to move too far out in maturity, yet we are seeing fund manager do so in moderation. Tight credit spreads don’t make a compelling argument for excessive credit risk, but discerning investors can profit from higher levels of yield. Our recommendation continues to be to stay close to policy targets in fixed income. We typically employ a mix of strategies and exposure and believe this diversification is particularly warranted given the opportunities (and risks) within a range of fixed income instruments.

EQUITIES

We don’t believe there is much debating the fact that US Large Cap stocks are expensive—by both historical standards as well as relative to other alternatives like US Small Cap and Non-US stocks. Given our cautious outlook, however, we are comfortable with the added security large companies offer relative to their smaller counterparts. Further, while valuations outside of the US are more attractive, we believe they accurately reflect the outlook and risks facing other developed markets. One potential contrarian point of view would be to look at Emerging Markets as one way of balancing out the risk and return implications of being somewhat overweight US large cap stocks. Emerging markets have typically been less correlated with US markets and therefore provide diversification. In addition, according to JP Morgan, market consensus is that earnings growth in emerging markets will reach almost 19% in 2024 and 15% in 2025. This point of view is certainly not devoid of risk, however we believe it could be an interesting barbell to consider. Our recommendation continues to be that clients who need liquidity can take advantage of the attractive pricing environment in the US and naturally rebalance an equity allocation that has likely drifted higher due to the market performance of the last 18 months.

REAL ESTATE

Real estate remains under pressure. According to CBRE research, transaction volumes in US real estate declined almost 20% year-over-year in the first quarter. The volume of loans coming due has not translated to higher transaction volumes, in part because many lenders have opted to extend loans when possible. In fact, CBRE estimates that the extension of loans in 2023 added an additional $271 billion of loans maturing in 2024. Barring an unexpected slashing of interest rates, real estate investors will need to realize some of the implied losses, which we believe is starting to occur episodically—particularly in office properties. Interestingly, transaction volumes in office properties have actually increased over the last 12 months, indicating that we may finally be near or at the bottom of that sector’s downward cycle that began almost 5 years ago. We remain cautious on core real estate, however we have been doing work on identifying potential opportunistic and value-add strategies that can add some risk in anticipation of a turn in the real estate cycle.

Final Thoughts

Based on the data that we see, we think it is more likely than not that the economy will continue to decelerate, potentially tipping into recession. Interest rates will eventually roll over, but our hope is that policy makers take the risk of resurging inflation due to premature rate cuts seriously. Markets are neither overly bullish nor overly bearish, which we view as a positive. In short, we think equity markets, fixed income markets and real estate markets are all appropriately priced given the outlook. As we all know, however, it’s the risks that we can’t see that tend to push markets to one extreme over another. For that reason, we believe it is important to revisit what we own, why we own it and what risk factors we are exposed to. It is an important step in our preparation and the one that allows us to make disciplined and unemotional decisions when volatility returns.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.