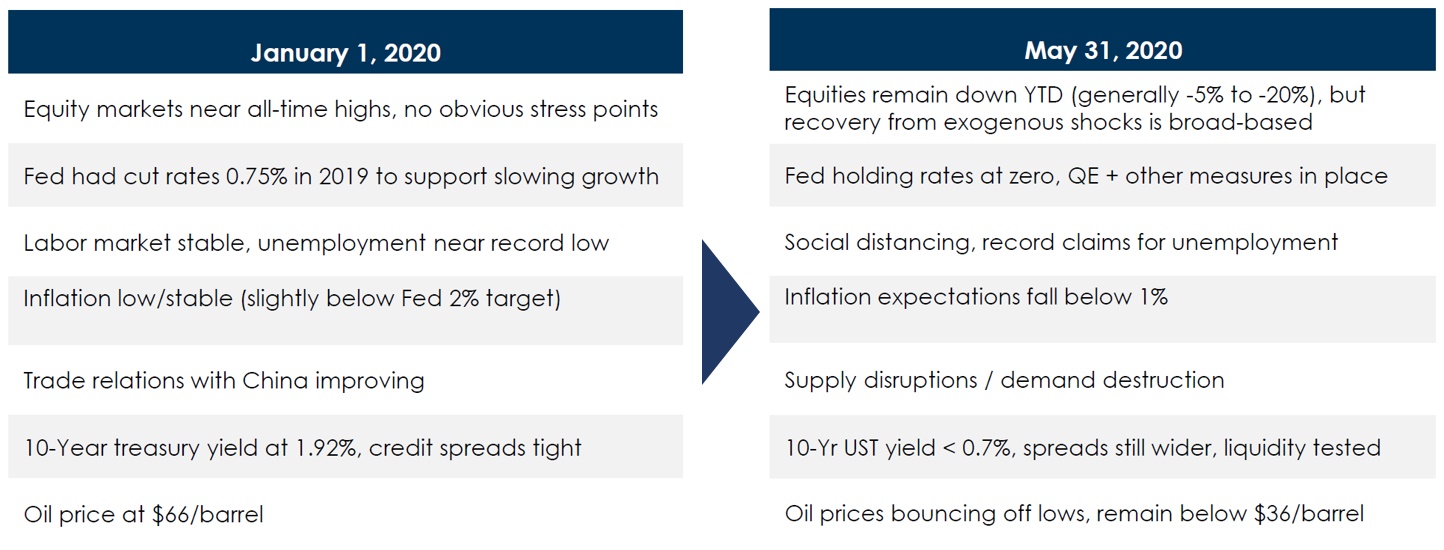

Can you imagine getting the chance to tell our January selves a little bit about where we would be at the halfway point of 2020? Would we believe it? The chart below by our colleagues at ACG identifies the drastic changes in the economic circumstances in our country from the beginning of the year.

First Quarter of 2020: Exogenous Shocks

A Change is Gonna Come

The period we are currently living through will likely result in some meaningful changes in the business landscape of the country. The degree to which it happens is a key nuance and where the potential for excess investment returns or risk may lie. In addition, while some of the phenomenon we are currently in are no doubt cyclical, we must also challenge ourselves to consider which ones might be structural in nature.

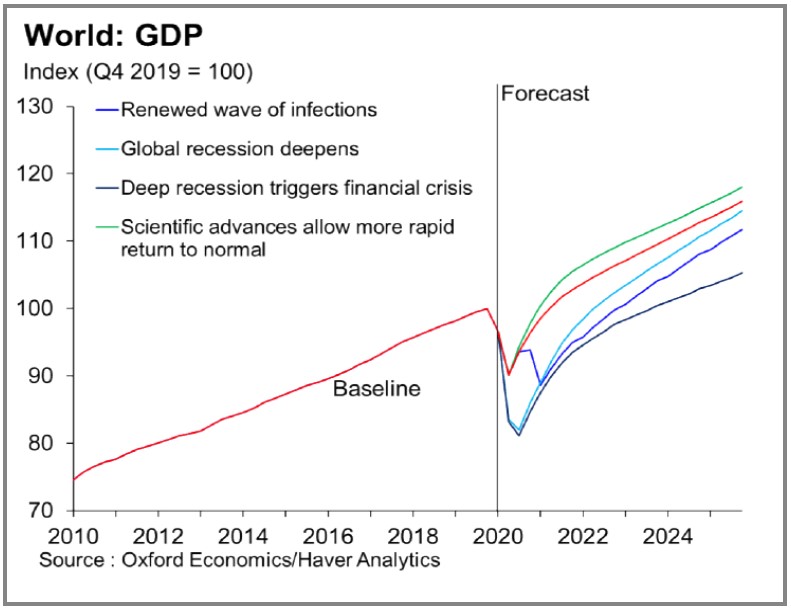

Fortune Magazine recently surveyed CEOs of the Fortune 500 on how they are dealing with the pandemic. There are some near-term and longer-term implications to the responses collected (see the full online piece here). Nearly a quarter have laid off 10% of their workforce or more: this is one example of the cyclical factors at play, though the length of the cycle is still very much an open question. From a longer–term perspective, a quarter of CEOs polled believe that their employees will never fully return to their usual workplace, suggesting structural implications for the future of office space. That being said, coming to any firm conclusion at this point may be premature, as we must acknowledge that the outcome is still in flux. As the chart below indicates, the range of possibilities and the length of time it might take for the Global Economy to recover to trend growth are still highly uncertain.

GDP Forecasts in a Covid-19 World

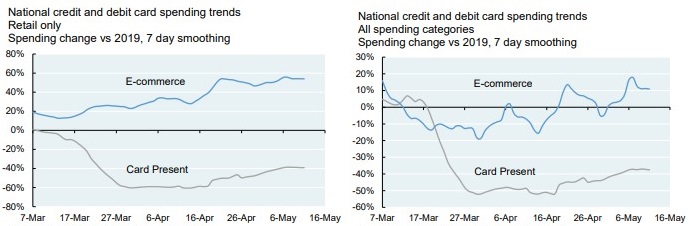

From a consumer standpoint, the chart below from JP Morgan illustrates the degree to which consumption patterns shifted to e-commerce during the pandemic, and the relative persistence in preferences despite economic reopening. These are just some of the questions that are facing investors today and ones that our equity managers are thinking through.

National Credit and Debit Card Spending Trends: Retail Only vs. All Spending Categories

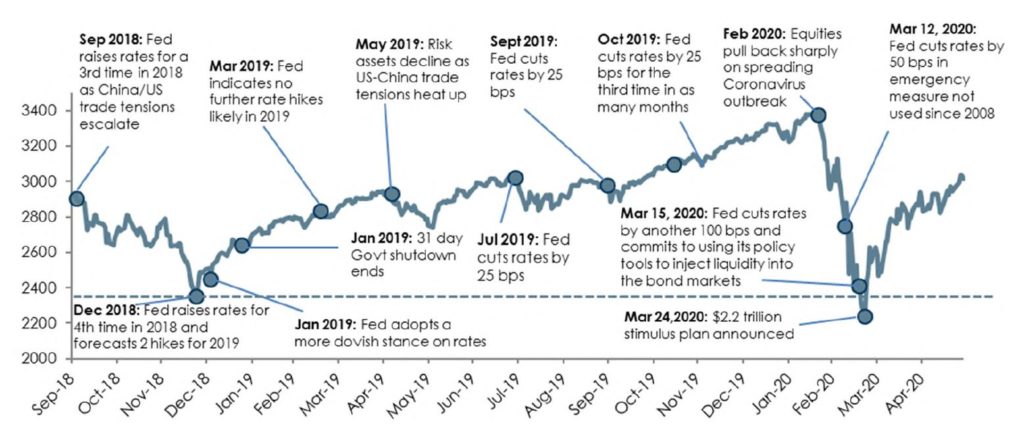

Don’t Fight the Fed

One of the interesting evolutions over the last decade has been the relative comfort that appears to have grown with the notion of quantitative easing. In 2008, when the Fed first began their program of quantitative easing, it was seen as an extreme level of monetary policy intervention. Fast forward to today, and the table below illustrates the expansion of the Federal Reserve’s toolkit to combat the pandemic.

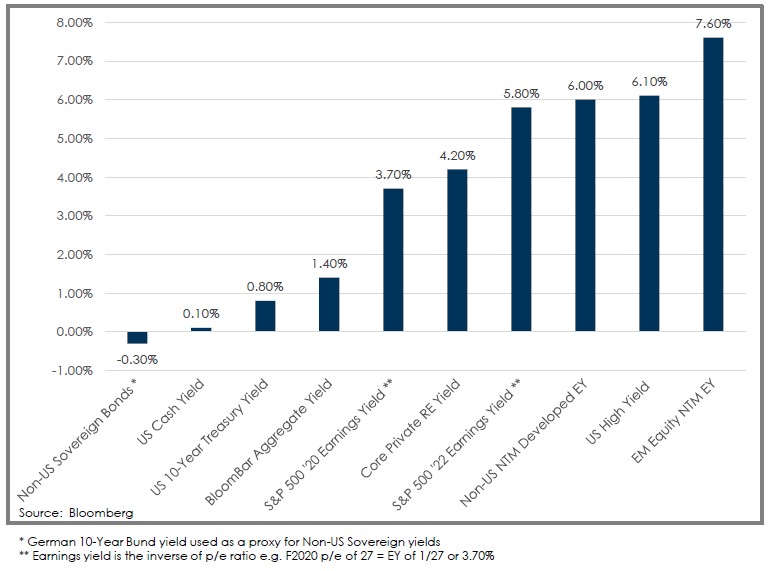

The direct result has been historically low interest rates. The secondary effects on non–fixed income assets have been just as significant. According to Yardeni research, the consensus forward earnings for the S&P 500 is just below $145 per share, which based on the June 30th closing price of 3,100, implies a forward P/E multiple of 21.4x. This is a level that we have not seen since the end of the dot-com era. So as a fixed income investor, one could look at the overall yield levels and conclude that there is little value in owning bonds. As an equity investor, one could look at current prices and conclude that future returns look muted as a product of current prices. Long-term investors and asset allocators, however, don’t have the luxury of seeing asset classes in isolation, rather they have to see them in relative terms.

As the chart below illustrates, on a relative basis, equities offer reasonable value when compared to traditional core fixed income.

Comparing Yields: Fixed Income vs. Various Equity Earnings

However, simply looking at the relative valuations underscores the importance of the uncertainty currently facing the equity markets in which we invest.

Portfolio Implications

So, what are investors to do? We continue to see three key tenets to current portfolio implementation:

1) Selectively Using Active Managers. While the final impact of the pandemic at this point is still a material unknown, it stands to reason that the level of disruption will result in a growing dispersion between companies that are able to adapt and those that are not. We believe this is particularly true in the case of smaller companies. Therefore, the use of active managers, who have the opportunity to add value by buying businesses they believe are best positioned to come out of the pandemic, seems like a reasonable use of our portfolio fee budgets.

2) Allocating to Private Strategies. For clients with the ability and tolerance for illiquidity, the inclusion of private assets— equity, real estate, or fixed income, could offer some additional return potential and near-term volatility dampening. We continue to maintain a long-term focus as it relates to investing in the current environment, a perspective that is largely ingrained in the private equity mindset.

3) Opportunistically Rebalancing Portfolios. We continue to advocate an active rebalancing strategy that keeps client portfolios close to their long-term targets and therefore manages risk. We have already experienced extreme levels of volatility, both in the market correction and the subsequent recovery this year. Uncertainty remains high and we anticipate continued volatility which could create opportunities and circumstances in which portfolios might drift from their strategic asset allocation targets. Our colleagues at Asset Consulting Group recently put this research paper together, which highlights the benefits and the considerations of portfolio rebalancing.

To a certain extent, the more things have changed, the more they have stayed the same. The range of possible outcomes remains broader than usual. In addition, with the US presidential elections four months away, volatility will likely remain a staple of the foreseeable future. We continue to favor a disciplined approach, but are constantly challenging our assumptions to make sure we remain nimble. As always, we appreciate the trust you place in us to help navigate these difficult markets and look forward to the next time we see you—either in person or on video.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.