“What can I expect my portfolio to do for me going forward?”

This is one of the most common things we hear from Matter families. While the question seems simple enough, the answer is often layered with nuance, disclaimers, and numerous variables. Unlike the weather, in finance, the closer the time horizon, the less reliable the forecast is. It’s simply impossible for anyone to know what’s brewing in the near term. Howard Marks of Oaktree wrote a great memo on forecasts a few months back and it is worth the read.

That being said, we do believe we can provide some directionally accurate expectations for asset class returns moving forward – and it’s important to consider them in the context of the wave we’ve ridden over the past decade.

- Over the last 10 years, the S&P 500 index has returned nearly 17% annualized, which is much higher than the historical average of around 9%.

- Bonds have been more subdued, with the Barclays Aggregate Index returning 3% annualized, though that is due, in large part, to the interest rate environment. (Ten years ago, the yield on the 10-year Treasury was 1.9% compared to around 1.5% today.)

- Given that most investors have 50% or more of their investments in stocks, the above-average stock market returns have generally resulted in above-average returns for their portfolios overall.

In sum, the past decade has been a great time to be invested.

The Next 10 Years May Not Reflect the Past 10

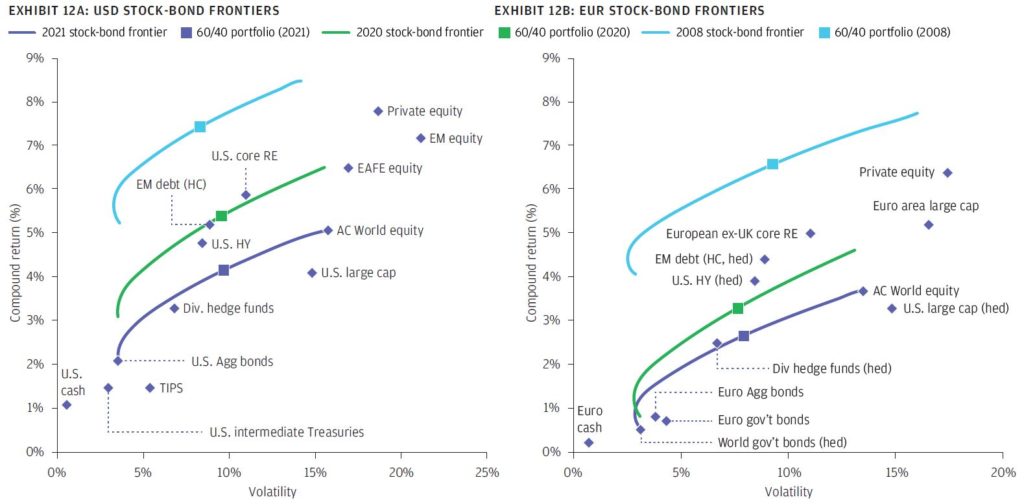

On the balance, the future return environment doesn’t look as bright as the past. We have to accept that recent returns may have been “borrowed” from future returns. Our colleagues at Asset Consulting Group use fundamental building blocks to construct intermediate and long-term return assumptions for all asset classes, and across the board, return expectations for the next 10 years are below their long-term assumptions—in some cases, materially so, with fixed income being a particularly challenging asset class. They are not alone, as the chart below comes from JP Morgan’s capital markets group and reflects how return assumptions have come down from 2008 through 2021—evidenced by the fact that the return expectations of a 60/40 (stock/bond) portfolio have declined from around 7.5% in 2008 to around 4% in 2021.

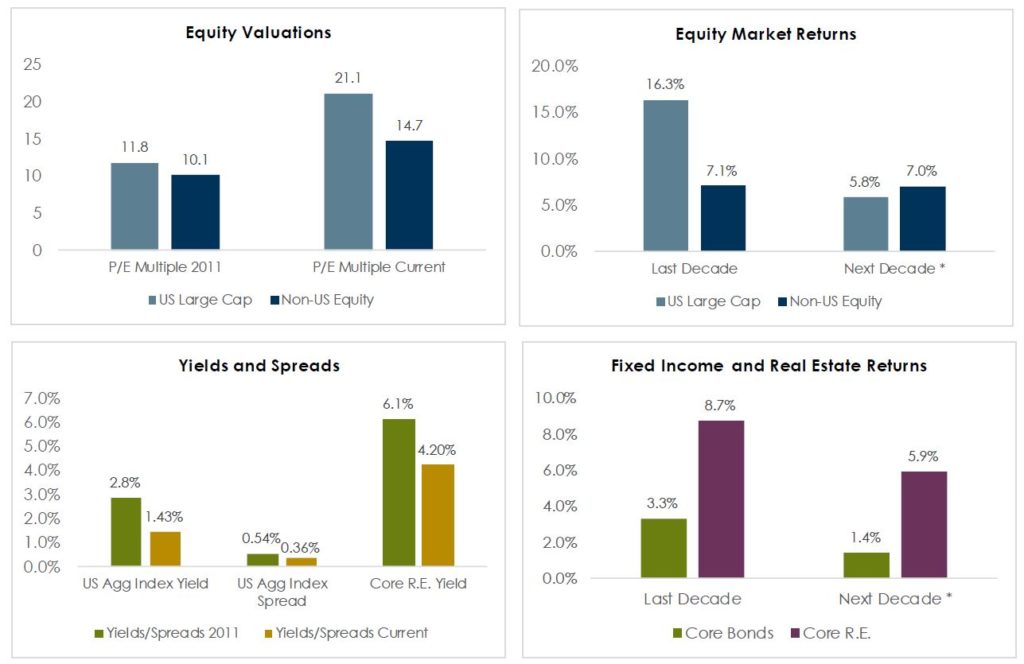

While any forecast should be met with an appropriate understanding of its limitations as a predictive tool, the trends are consistent. As the chart below implies, a low yield environment coupled with relatively high equity valuations implies lower returns going forward.

Three Themes for Navigating the Next Decade

If the backdrop is that returns across asset classes may be lower over the next 10 years than they have been over the last 10 years, the question becomes how we contend with that environment. First a disclaimer, ultimately we are all investors in the same asset classes, so anything we do should be viewed as a potential enhancement of returns on the margin, as opposed to some miracle investment that somehow is not subject to the same circumstances as all other investments.

There are three key themes that apply to all asset classes that will allow investors to navigate a potentially more muted return environment:

- Flexibility

- Liquidity Planning

- Discipline

Flexibility

The more tools investors have in their tool chest, the more opportunity they have to adjust to a given market environment. A direct example of that perspective could be in fixed income portfolios. At the highest level, there are 3 core risk factors to which investors in fixed income can be exposed. Interest rate risk (duration) is the risk to the price of the bond they own to changes in interest rates. Credit risk is the risk that the loan will not be repaid on time and in full. Liquidity risk is the degree to which there is a predictable and consistent market into which the bond can be sold at a given time. Traditional bond portfolios have typically concentrated in high-quality core bonds, which effectively has meant a concentration of interest rate risk—since these bonds are typically issued by high-quality companies, governments and municipalities typically have a broad and liquid market. We continue to favor a balanced approach that includes both high-quality core bonds, but also adds multi-strategy managers that have the flexibility to allocate across different sectors of the bond market depending on where they see value as well as liquid absolute return managers that have the flexibility to be both long and short differing assets and risk factors within fixed income. This added flexibility affords us the potential to navigate a rising and/or volatile interest rate environment.

Liquidity Planning

Our perspective as a family office affords us invaluable insights into our families’ goals and objectives and the balance sheets they have to support them. A key component of this process is understanding their liquidity needs and from where they might need to be sourced. By spending significant time talking with our families about their cash flow needs, we can reduce the possibility of unexpected liquidity demands, which consequently affords us the opportunity to take on illiquidity in their portfolios, where appropriate.

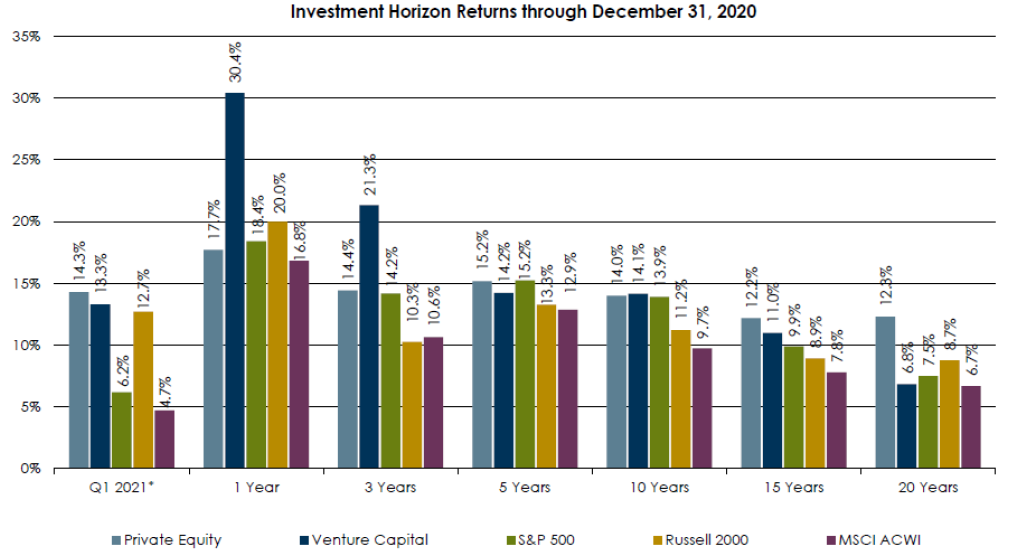

This has an important impact on the return expectations for portfolios going forward. Historically, there has been a return premium afforded to investors willing to take on illiquidity in the form of private investments. The chart below illustrates the returns in private equity over the last 20 years.

There are some important considerations when making private investments: fees, complexity, manager selection, vintage year, and strategy diversification, and not the least of which, liquidity. However, we continue to actively look for private strategies across all major asset classes (fixed income, equity, and real estate) as a way of providing additional return opportunities going forward.

Discipline

Know thyself. The single most important decision any investor can make is to decide on what amount of return and what level of risk we are willing to take in pursuit of our goals. Given current interest rates, investors are almost being forced into riskier asset classes in order to achieve the returns they have come to expect. This creates the potential for a misunderstanding of risk tolerance that puts us into a riskier position than we would otherwise choose to put ourselves.

Now is the time to reassess goals and objectives. Now is the time to reconfirm risk tolerance. For those whose balance sheets have grown materially over the last several years, it could put them in a position to take on more risk and therefore increase potential returns. For those who have had major liquidity events and are now drawing on their portfolio more consistently, it could mean a reduction in the amount of risk they are willing to take. Either way, we have the opportunity to re-confirm where you want to go and how you want to get there, and we’d be smart to take advantage of it. Not only does it allow us to avoid getting sideways from a risk perspective, but it re-affirms our resolve in the plan we have in place, which provides us with the discipline to stay the course if and when the environment becomes more volatile and challenging.

Our responsibility at Matter is to help our families build strategies and find opportunities in any investment environment. This starts with a deep understanding of their balance sheet and the resources they have at their disposal and how we can align them with the goals and objectives they have for their financial capital. When coupled with an investment philosophy that emphasizes research and open architecture, we believe planning for flexibility, liquidity, and discipline will help us position ourselves responsibly regardless of the return environment.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.