As we kick off a brand new decade—and our 30th year of working with Matter families—we’re taking some time to reflect. Our investment committee has been reviewing the past 10 years to gain perspective on where we’ve come from, where we are now, and where we might be heading, economically and financially.

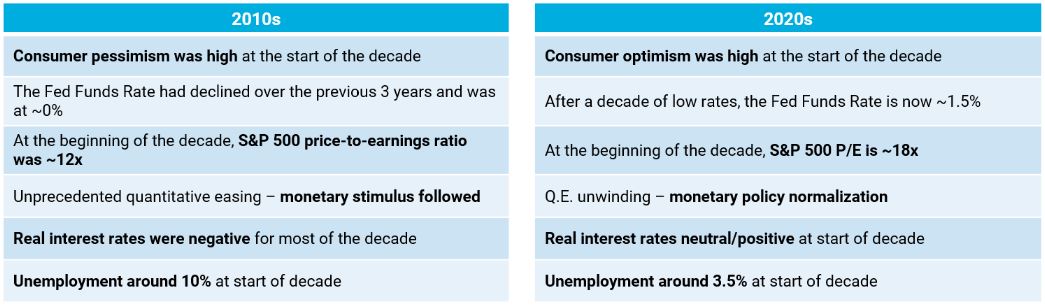

But, before we get too deep into the data, here’s some interesting context: in 2010, Apple unveiled the first iPad and the iPhone 4. We are now on the 7th generation of iPads, and iPhone versions are in the double digits! From a 2010 financial perspective, the world was still reeling from the effects of the Global Financial Crisis of 2008 and 2009. Unemployment was around 10%, the Federal Reserve had just finished cutting interest rates to right around 0%, and there was little debate as to whether they’d be rising anytime soon. Consumer sentiment had rebounded from 2008 lows but was far below its historical average. From a market and economic perspective, the 2010 world was still in recovery mode.

What a contrast with where we are today! The unemployment rate is at the lowest level since the 1970s. While interest rates remain low, there is now a reasonable debate as to whether the Fed will cut, hold, or raise rates. Consumer sentiment has rallied and is supporting strong spending growth in the US, with personal consumption expenditures increasing 3.9% in November 2019.

Comparing the 2010s and 2020s

So, you may ask, when’s the next cliff?

For those who were hoping to find an answer to that question in this update, we apologize in advance for the disappointment. But do keep reading. A review of our investment management themes, the current factors at play in each, and how we think through it all from a portfolio implementation standpoint might scratch that itch, if only ever so slightly.

Risk and Uncertainty

We opened the year with a stark reminder of the constant potential for volatility. As news broke of a US military strike on Iranian General Qasem Soleimani, the S&P 500 opened down, around 1%, and the 10 Year Treasury yield dropped by 4% to 1.8%. While it seemed like a textbook risk-off trade, the market shrugged it off over the next few days and was at new highs within a week. In the bigger picture, while we appear to have gained some additional clarity on issues surrounding Brexit and US/China trade tensions, it is important to remember that these policies are far from being crystalized, and much can change.

→ Our message on this front continues to be to maintain global diversification and use the current market highs as an opportunity to raise cash for known lifestyle spending needs, when appropriate.

Growth

The US appears to be on relatively solid footing when considering some of the following factors. Our economy largely relies on consumer spending (consumption represents approximately two-thirds of US Gross Domestic Product), and historically low unemployment is supporting wage growth, which peaked in October at 3.6% annualized, but moderated to slightly above 3% in the final two months of the year. Low interest rates are further bolstering the consumer’s position, as the total cost of servicing debt is at the lowest levels it has been in 30 years. The Global Economy appears to be humming along, as well. However, the Purchasing Managers Indices (PMIs), which are measures of activity and outlook, show a diverging trend between manufacturing and non-manufacturing businesses. The latter saw its 125th consecutive month of expansion in December 2019, while manufacturing businesses are contracting amidst signs of late-cycle strains and the impact of trade tensions. The recent outbreak of the coronavirus in China has clouded the growth picture, though it is far too early to estimate the impact on the global economy. Looking back at other recent outbreaks (SARS, H1N1 and Ebola) yields little in the way of insights, as the true economic impacts are inconsistent and notoriously hard to gauge.

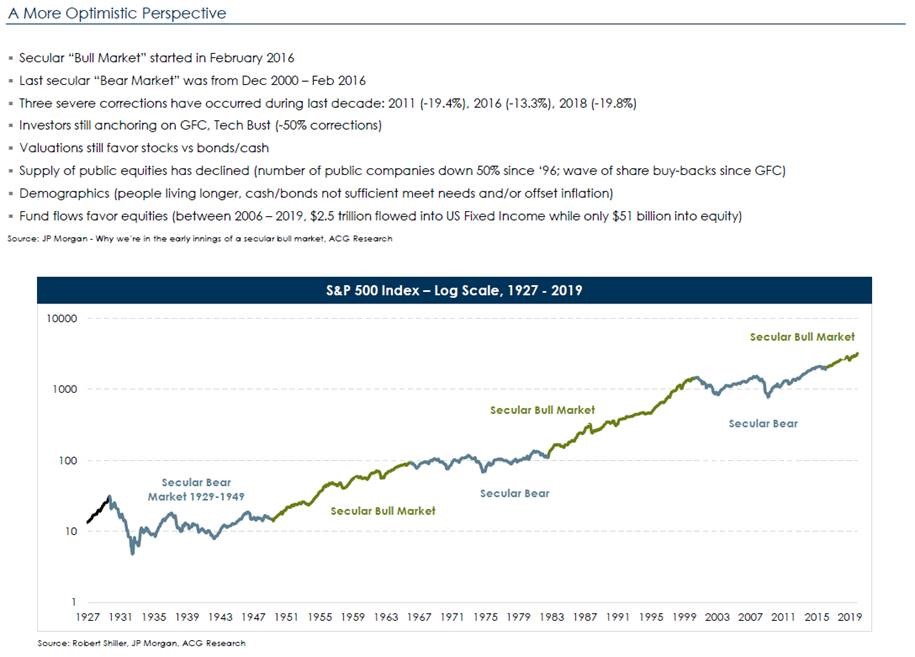

→ All in all, the global growth backdrop shows some late-cycle signs but has enough stamina to justify our current allocation to stocks. As the ACG chart and table below reflect, some optimism is warranted.

Yield Environment

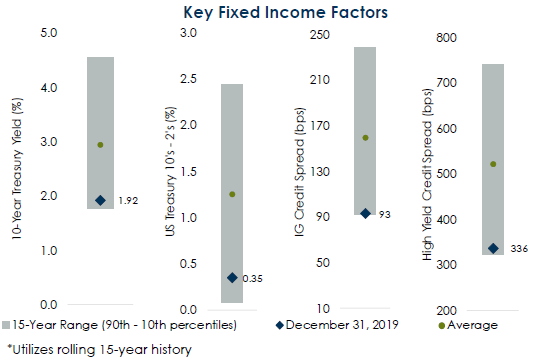

The interest rate environment remains extremely challenging. Spreads—which reflect the added return investors are getting paid to take on additional risk (be it term risk or credit risk)—remain very low. The chart below illustrates the “tightness” of spreads and how little investors are receiving in return for buying longer-term or lower-credit bonds. The direction of Fed Interest Rate policy remains a major question for 2020, though at their meeting last week, the Fed voted to hold interest rates steady.

→ Ultimately, we believe there is value in being nimble and continuing to overweight bond managers with more flexible strategic mandates.

Investment Implications

As always, the operative question is: What does all this mean for portfolio management in the current environment? At the risk of sounding repetitive to the families we serve, I’ll restate one of our core investment principals. We invest for the next 10-20 years or more—not for the next 12 months. That said, we’re not oblivious to the prevailing conditions and would make the following observations:

Raising known cash needs at this time is reasonable.

We are not calling a top on the markets, but if we agree that valuations are higher than average, that by definition means that we are getting at least a reasonable price for the assets we sell and could therefore avoid having to raise cash at inopportune times if some of the near-term risks materialize.

Don’t get cute—stick with long-term strategic targets.

Let the long-term investments you have work for you in this moderating growth environment.

Affording flexibility to the managers in your portfolio has merits.

Within Equities, active managers in certain asset classes, in particular US Small Cap, Non-US and Emerging Markets, have tended to provide some measure of outperformance later in cycles. Within Fixed Income, flexibility to navigate the uncertain yield environment makes sense.

As we get further and further into this market cycle, it is only natural to look for the next inflection point. History will argue that we’re due for a recession, and yet history also argues that we will recover from a recession and grow from there. So, while we spend considerable amounts of time working through the data to determine where we are on the road to growth, our primary objective is to make sure that investors have the appropriate portfolio for their long-term journey.

The unemployment and wage data is from the St Louis Fed’s database, The earnings information is from Factset and the PMI information is from the Institute for Supply Management.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.