Earlier this year, we wrote about the implications of Russia’s invasion of Ukraine. While the markets were reacting negatively to the news of the conflict, in reality inflation and Fed policy had already been weighing on investors’ minds. With the news of the FOMC’s decision to raise interest rates by 50bps last week and the corresponding volatility that has returned in both equity and bond markets, it seems investors have awoken to the reality that the economic conditions moving forward will prove more challenging and less accommodative than in the recent past.

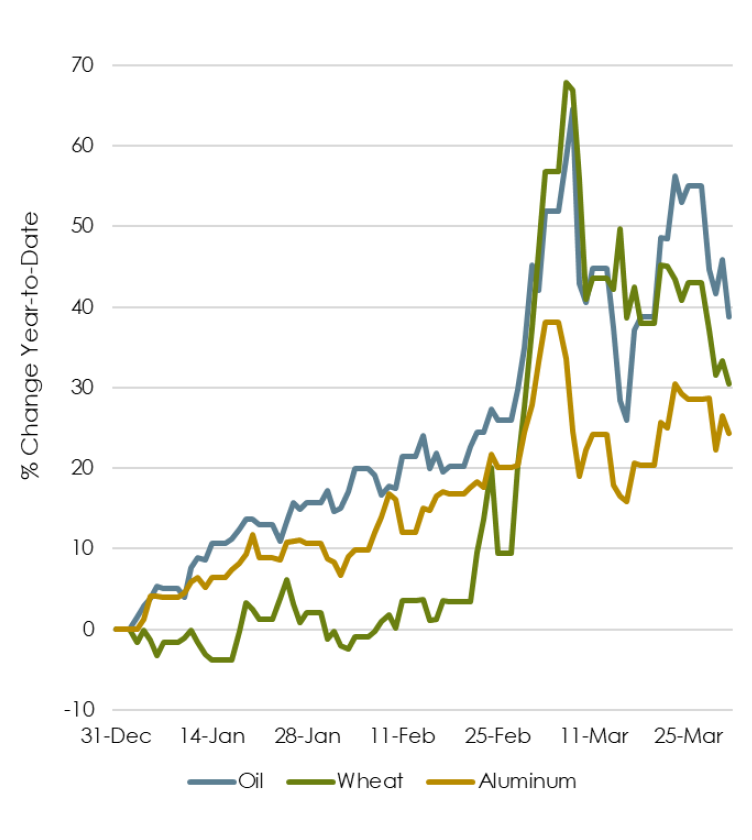

Over the last few months, we’ve seen two key developments take shape. First, the war in Ukraine has become a more prolonged and brutal war of attrition. As the chart below illustrates, the war has triggered a significant increase in key commodity prices, further exacerbating inflation pressures. Second, we are seeing a general repricing of risk assets as credit spreads have widened and equity multiples have contracted—particularly within high growth companies. With increasing geo-political tensions, supply chains that are not fully resolved and tightening monetary policies, it is important to look for a reasonable point of view on the current risks and opportunities.

The Rising Risk of Recession

While our crystal ball remains in the shop, we have to acknowledge that the risk of a recession has risen since our last blog post. Several weeks ago, the Bureau of Economic Analysis released the initial Q1 2022 Real—or inflation adjusted—GDP estimate, which showed an annualized decline of 1.4% in the first quarter. This number is subject to revision, but if we peel back the onion there are some undeniable trends. Unsurprisingly, inflation had a significant impact on the real level of economic output, as Nominal GDP (which is not adjusted for inflation) grew at 6.5%. Further, as we found out last week from the Bureau of Labor Statistics, the first quarter saw the largest year-over-year change in unit labor costs since 1982. All of this points to inflation levels that are not merely being driven by commodity shocks and paints a picture of the difficult task the Federal Reserve has in containing inflation while engineering the fabled “soft landing”.

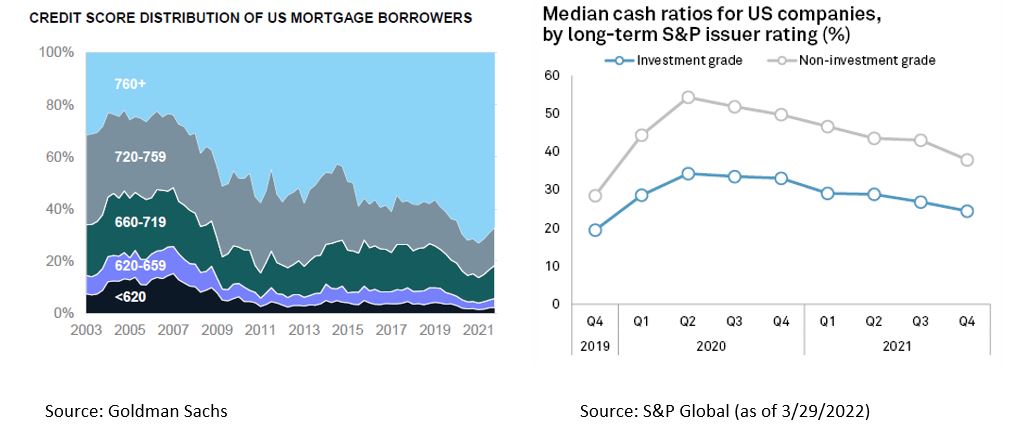

But all is not rotten in the state of Denmark, or the United States in this case. As of May 6th, according to Factset, of the 87% of companies in the S&P 500 Index that have reported earnings, 79% surprised to the upside, and this despite declining profit margins. Moreover, as the two charts below indicate, both corporate and household borrowers are in relatively strong financial positions and, in aggregate, should be able to weather tighter economic conditions.

We don’t say this in any way to discount the recent volatility or the real concerns regarding the likelihood that the Federal Reserve can unwind over a decade of accommodative monetary policy in an orderly fashion. However, the stock market is a marketplace, and prices—over the short run—are driven by fundamental supply and demand dynamics. When there is an imbalance between buyers and sellers in the marketplace, we experience periods of either euphoric rallies (buyers outnumber sellers) or dramatic sell-offs (sellers outnumber buyers). Our duty is to stay above the near-term fray and make informed decisions about the value of the investments we own. We believe that investors who are able to stay focused on the fundamentals of the businesses they own will be rewarded for their patience and discipline.

Portfolio Opportunities

The question becomes where do we go from here and what options should we be weighing? Conceptually, we view our portfolios as a combination of four major asset groups—cash, bonds, stocks, and real estate. Each presents its own sets of circumstances and strategies, though there are some common threads.

Cash

We continue to believe that there is value in maintaining liquidity for lifestyle spending and as such are advocating keeping at or around 12 months’ worth of reserves. While interest rates on money markets have been slow to adjust to the Fed’s rate-hiking cycle, and we are conceding some loss of purchasing power to inflation, we believe it is an important hedge to avoid having to be a seller into an over-crowded selling market.

Bonds

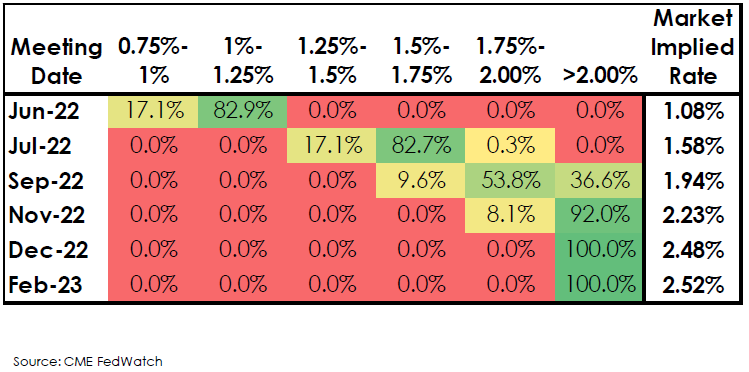

The pressure will be on the Fed to contain inflation, while not raising interest rates to such a degree as to destroy demand. The futures implied probability chart below, which illustrates the probability that the market is assigning to a given interest rate range at a given date, shows that the market is pricing in an additional 5 rate hikes by the end of the year. Therefore the question isn’t whether we think the Fed will raise interest rates, but whether we think they will raise them by more or less than what the market is pricing in. In this environment, we continue to place a high premium on flexibility. Multi-sector and Liquid Absolute return strategies continue to make sense, but we may soon find opportunities to re-invest in core bonds at more attractive long-term yields.

Stocks

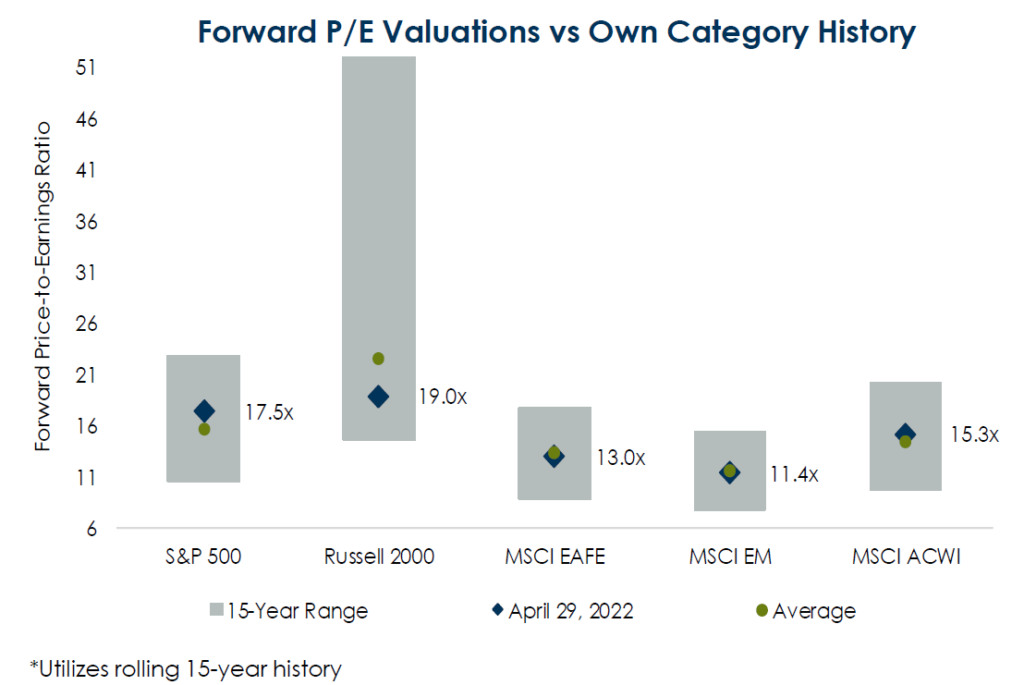

Stock markets are caught in a similar transitional stage. With the Nasdaq down around 25% YTD, the market has made it clear that it is rethinking the rich valuations it afforded growth stocks. A question we are asking ourselves, however, is whether the recent selling pressure has created buying opportunities. Several of the managers we have spoken with over the last few weeks have been using this volatility as a time to increase high conviction positions across their portfolios. In some cases, they have been early and there could be further downside to come. At the same time, as the chart below illustrates, valuations are back to within reasonable ranges. So while we are prioritizing maintaining lifestyle cash reserves, we are also on the lookout for opportunities to rebalance.

Real Estate

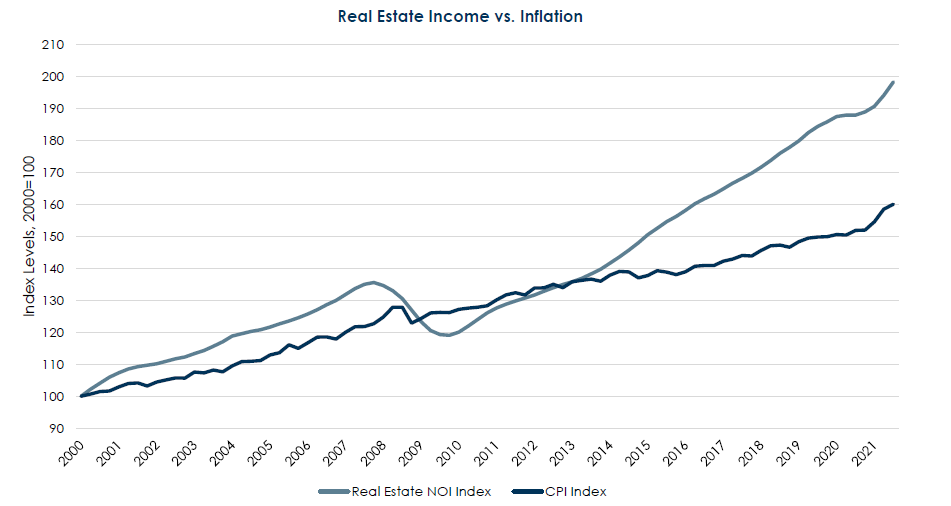

Real Estate is often cited as one asset class that provides a partial hedge against inflation. The chart below reinforces that belief and supports our conviction that core real estate remains an important component of investment portfolios.

In addition to core real estate investments, we continue to explore opportunities—specifically within private real estate—for additional incremental returns by allocating to more opportunistic and value-add oriented investments. While Industrial and Multi-Family Residential are consistent themes among managers, there are also some niche or contrarian opportunities that we believe can be additive over the long run.

The market volatility over the last several weeks serves as an important reminder that everyone’s circumstances, tolerance for risk, and needs are unique. Some of our clients have recently experienced liquidity events and are putting their cash to work, others have fully invested portfolios off of which they are living, and others still are invested and planning their futures around expected growth. In all cases, it’s hard not to experience days like last Friday (when the markets sold off 3%+) and question whether we should be taking drastic action. But we have seen these markets before and believe that it pays to be an optimist in the long run. We will continue to evaluate the incoming data and look for opportunities to challenge our assumptions.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.