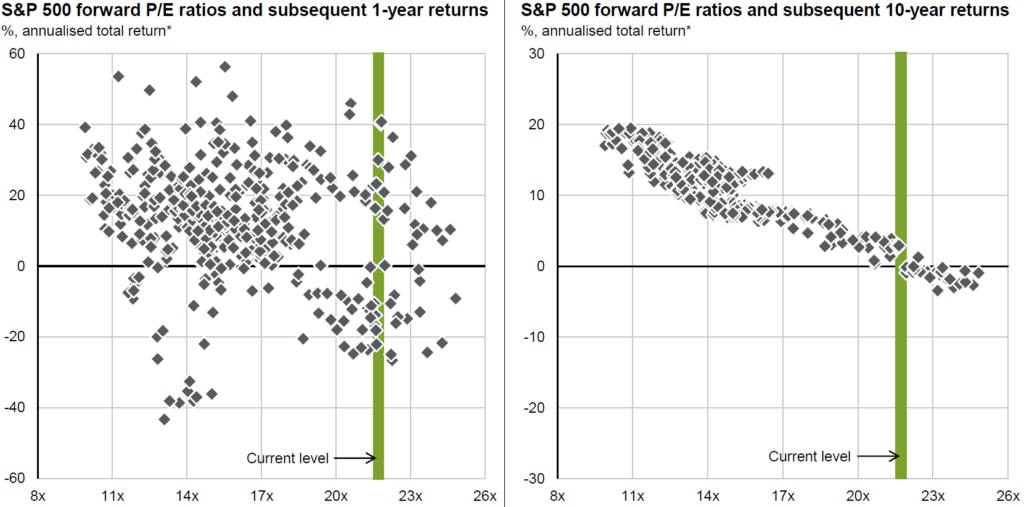

One of the trends we spotlighted in our most recent quarterly commentary is the current valuation levels in public equity markets and what it means for forward-looking returns. There’s no doubt that valuations can remain extended for a prolonged period. However, history has shown us that markets that start at current levels typically experience lower returns over the ensuing 10 years. The charts below are from the J.P. Morgan Guide to the Markets, and they highlight two concepts in graphical terms.

The chart on the left shows that current valuation levels have little predictive value as it relates to the following 12-month market returns—with investors at current levels having experienced anywhere between -25% and +40%. As you look out further into the future, however, the trend becomes clearer—which is reflected in the chart on the right. Historically, when markets traded at current forward price-to-earnings ratios, the following 10 years produced annualized returns between around -1% and 3%.

Given lower projected returns for public stocks, the question we must ask ourselves is what opportunities might be able to increase our returns on the margin? One potential answer for those who can afford the illiquidity is private markets. We have been long-term investors in private equity, private real estate and private credit and are familiar with both the risk and return opportunities within these markets. While they are not immune to fluctuations in valuations—between cheap and expensive—they do offer some unique inefficiencies that create opportunities for discerning investors. The market has grown significantly over the last decade. According to research by Ernst and Young, global private capital markets grew from $4.4 trillion in 2012 to over $14 trillion in 2023. Yet despite this growth, Preqin estimates that private equity still only owns ~5% of the companies in the US that have sales in excess of $10 million. We believe this presents long-term investors with an attractive opportunity set.

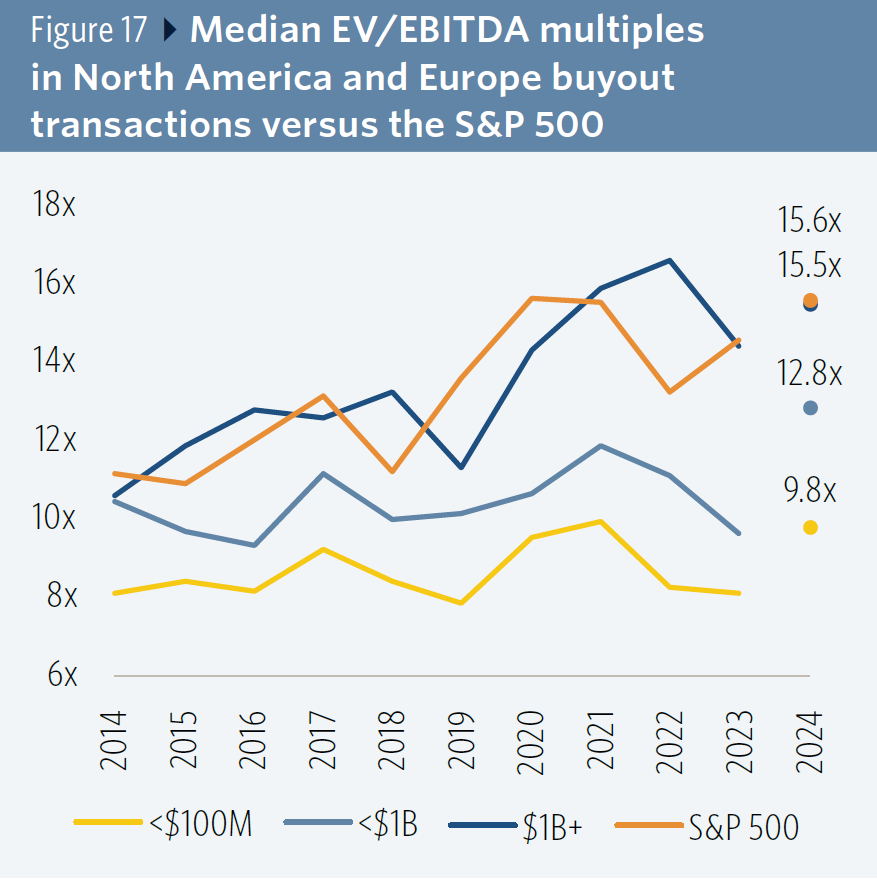

High Valuations Are Not Just a Public Market Phenomenon

As the chart below illustrates, valuations across the private equity landscape are not inexpensive by historical standards—specifically in transactions exceeding $1 billion. Similar to public markets, larger deals/businesses have commanded a premium.

There is no doubt that lower interest rates in the future could help rationalize these valuations. All else being equal, the lower and middle markets are more reasonably priced. However, valuations cannot be the sole rationale for investing and therefore we continue to favor fund managers that can expand beyond simply financial sponsorship and have a track record of driving value within their underlying businesses. At its core, this is an area in which private equity investors are uniquely suited due to the typical investments and the more active nature of their ownership. Great private equity firms are able to increase the enterprise value of businesses in several ways depending on the stage, profile and nature of that business. Great private equity firms also have established playbooks for driving value. Whether they utilize programmatic M&A to expand product/service lines, geographic footprint or scale, professionalize operations or sales, identify strategic partnerships or accretive spin-outs—the ability to effect change and drive value can be amplified through private ownership and will be critical to generating excess returns in what is, admittedly, a higher cost environment. As is the case in public markets, we believe the quality of a company’s management team (and their strategic partners) should continue to be an area of focus for investors as they explore both public and private investment opportunities.

Portfolio Backlogs, Dry Powder and the Secondary Market

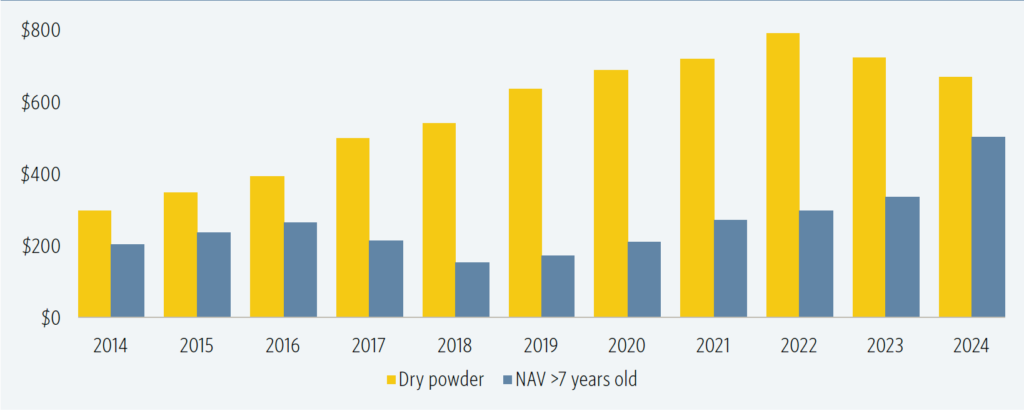

Similar to public markets, the private equity market has had to navigate the most recent market cycle, which began with the post-COVID recovery leading to the Federal Reserve’s interest rate hikes and then subsequently into the start of the monetary easing cycle. The result is a combination of competing factors—highlighted in the chart below from Pitchbook.

On one hand, general uncertainty surrounding the direction of interest rates has resulted in a somewhat tepid selling environment as evidenced by the growing number of companies held in buyout fund portfolios that are over 7 years old. On the other hand, while fundraising has been more challenging in the last couple of years, there remains quite a bit of dry powder for funds to deploy. We believe there are a couple of implications to this dynamic.

- The first is that, while valuations are high, with over $600 billion of dry powder in buyout strategies alone, we think the recent trend of sponsor-to-sponsor exits will persist.

- The second is that aging portfolios are likely to create demand for either continuation vehicles or secondary transactions.

Opportunities Ahead

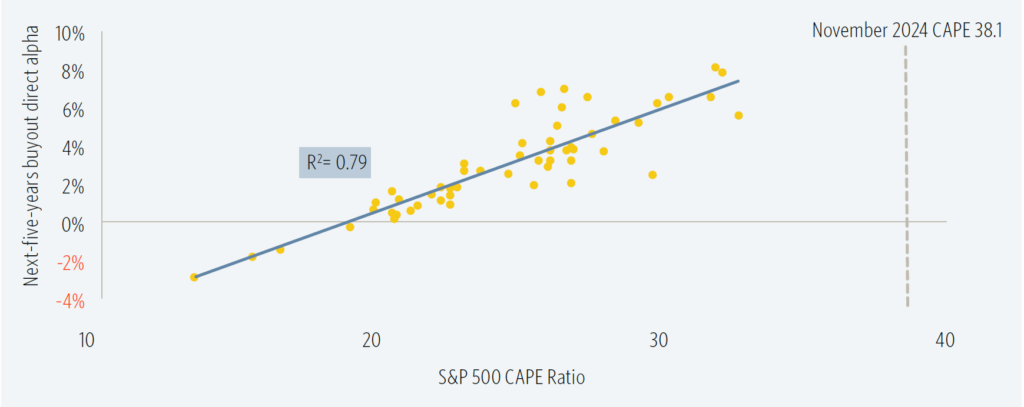

It is important to remember that the factors driving long-term business value are generally the same, whether you are investing in a publicly traded or privately held business. Growth and profitability drive value in the long run. That being said, to take a concept from Benjamin Graham, the daily voting mechanism of the public markets does create a higher likelihood of price distortions—be it euphorically high or pessimistically low implied valuations. While we can’t definitively say stocks will not get more expensive tomorrow, we can reasonably state that they are relatively expensive today. As the chart below illustrates, historically, when public stocks are as expensive as they are today, the relative return opportunity in private equity (compared to public equities) is attractive.

To that end, we are actively reviewing a host of strategies that cover a wide spectrum of the private equity landscape—which includes venture, growth, buyout and distressed. We are seeing some compelling funds coming to market in the lower middle market segment and do think reasonable valuations and opportunity for value-creation warrant the added diligence. Within the venture market, a rationalization in valuations and the potential thawing of the IPO market should bode well for future vintages—though we would prioritize funds with a disciplined deployment process over those trying to redeploy too quickly into this market. AI startups have and are likely to continue to command a significant amount of attention and pricing premiums. The recent news regarding DeepSeek could temper animal spirits, but the fear of missing out on the next great startup will likely put a floor under how low valuations will go in the near term. In the mid to longer term, we are more interested in companies that leverage AI. This interesting article by Databricks highlights the idea that the power of AI will not be in an individual model, but rather the system of models.

Lastly, we think the opportunities within secondaries could continue to be a compelling way to gain exposure to great private companies, while also helping to mitigate some of the J-curve inherent to private equity investing. Between funds being launched by Truebridge Capital, RCP Advisors and Apollo, we are seeing a range of secondary opportunities across venture capital, small buyout and large buyout funds alike.

Whether private equity is suitable for any client depends entirely on their time horizon, tolerance for illiquidity and sophistication. However, we believe that a well-constructed private equity program has the potential to add value to a client’s overall investment portfolio. Given today’s market environment, we believe that the relative opportunity set is more favorable than it has been in recent years.

About Thierry J.D. Brunel

Thierry joined Matter in 2013, bringing years of experience in family office and wealth management. He previously worked in investment research and portfolio management roles at Convergent Wealth Advisors and GenSpring Family Office. At Matter, Thierry leads the investment committee, advising families on portfolio strategy and governance. A Wake Forest University graduate, Thierry has a diverse international background. He’s active in his community, serving as an assistant coach for the John Burroughs School Varsity football team in St. Louis.

Other Blogs by Thierry

This report is the work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.