Investment Themes – What Matters?

- Election Impact – US elections are a looming factor, but their market impact is often overstated. Fiscal challenges, like rising debt and the expiration of the Tax Cuts and Jobs Act, are more pressing concerns.

- Fed Policy & Economic Outlook – The Fed’s shift in policy has begun, but the pace of future easing might be constrained by a US economy that continues to grow at a healthy pace, supported by job growth and strong performance from the services sector.

- AI Tailwind – This 21st-century arms race is driving significant investments in AI and related infrastructure, both of which could boost long-term productivity and economic growth.

- Portfolio Strategy – Global stocks, real estate, and bonds have all performed well year-to-date. We are focused on generating yield in fixed income, some profit-taking in equities, and opportunistic investments in real estate, distressed credit/special situations, and a sustainable transition.

There is no absence of storylines vying for investor attention as we enter the last quarter of the year and review the investment themes. The Fed shifted its policy stance in September and markets are now trying to process the outlook for interest rates in the near term. To make the situation more complicated, we are also less than a month away from elections here in the United States. Despite this, portfolios are faring well so far this year. We are midway through October and global stocks are up around 20%, global real estate is up slightly more than 10% and investment-grade bonds are up just under 3%. Good results all things considered. Earlier this year, our take was that economic activity was likely to decelerate on the margin, but that valuations across equities, fixed income, and real estate were reasonable and that no major rebalancing was warranted. The question becomes: Where do things go from here?

Investment Themes: How Will the Election Impact Markets?

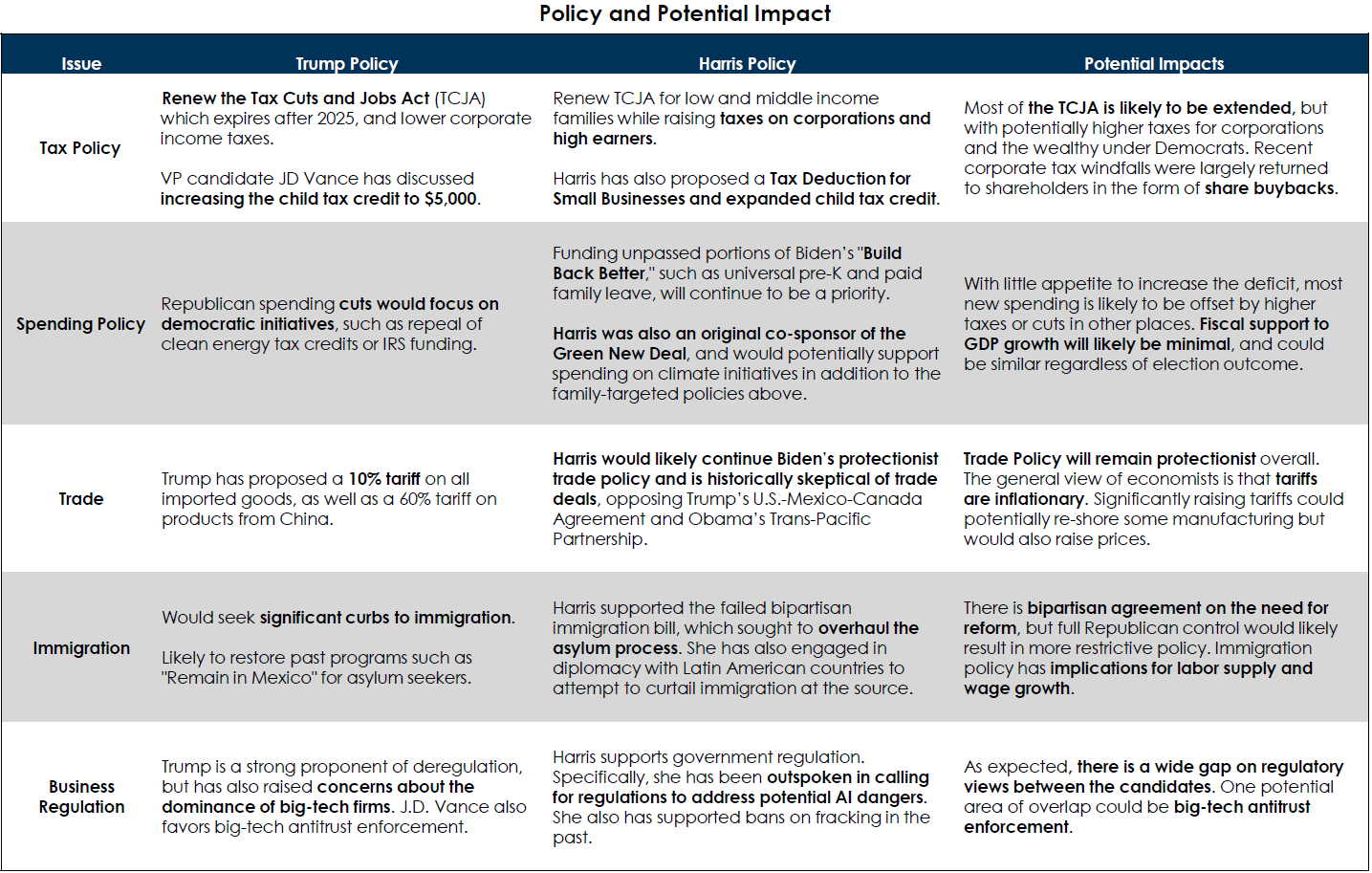

While we don’t want to dwell on the question, as we think the actual impact on markets is typically overstated, we need to address the elephant in the room: The U.S. election. We have and will continue to see many analyses surrounding each candidate’s proposed policies and their hypothetical impacts on the economy. Below is a summary created by our research partner, Asset Consulting Group. In addition, two strategists I appreciate reading are Michael Cembalest of JP Morgan and Howard Marks of Oaktree (their articles are linked below):

Truth be told, we find it intellectually stimulating to read all the various analyses and think through the implications of what could happen if each candidate was able to implement their policies exactly as stated. We all agree that the likelihood of being able to do that is remote and defies political reality. Additionally, as Howard Marks highlights in his piece, many of the policies simply do not reflect a cogent understanding of basic economic theories. These analyses aim to simplify a complex economy and rarely, if ever, are they able to see the second and third-order effects. In other words, it’s a good intellectual exercise, but rarely (if ever) should someone make investment decisions based on promises made on the campaign trail.

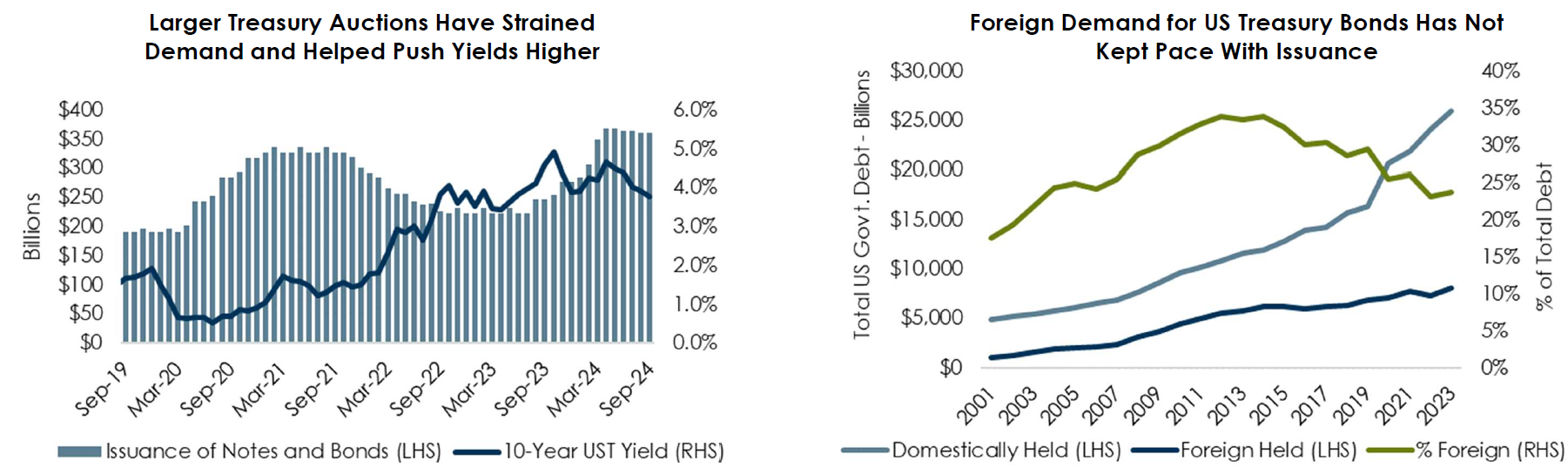

There is, however, one consistent thread, which is the general fiscal irresponsibility being demonstrated by both candidates and policymakers. As our national debt continues to grow, the cost of that debt is nearing concerning levels. According to the US Treasury, the government spent $843 billion in net interest costs in Fiscal Year 2024—making it the third largest budgetary outlay behind Medicare ($850B) and Social Security ($1.4T). This represents approximately 3% of US GDP, which is the highest level we have seen since the mid-1990s. The trajectory of our debt has yielded a couple of key concerns: could the US dollar lose its reserve currency status (like the UK pound sterling did following World War II) or, worse, could we be seeing a repeat of Argentina’s collapse around the turn of the century? To be clear, we don’t believe the latter is likely. When considering the US dollar’s reserve currency status, we believe the ability of the world to wean itself off its dollar reliance is likely to be a gradual process. According to the Bank of International Settlements, the US dollar is still used in approximately half of international trade invoicing. But, as the charts below highlight, demand for US Treasuries from foreign investors has been steadily declining over the last decade. Higher supply and lower marginal demand of US Treasuries would seem likely to put upward pressure on rates or at the very least limit the degree to which longer-term yields can decline.

Ultimately, we have no clear foresight into who will win the election in November, but whoever wins will inherit a government facing increasingly significant fiscal pressures in the long run.

Investment Themes and the AI Effect

Our analysis of the US economy suggests that it is not as weak as some maintain and that inflation is not as contained as most would want. There is no arguing that the economy has slowed as a result of the Fed’s historic monetary tightening cycle. The Conference Board’s Leading Economic Index has declined steadily this year. The ISM’s Manufacturing PMI has been below 50 (indicating a contraction) since December 2022—except for one positive reading in April of this year. Personal spending growth has also slowed. Yet, despite having slowed, the economy is still growing at a relatively robust pace. According to the Bureau of Economic Analysis, the US economy expanded at a 3% annualized rate in Q2. Further, the Atlanta Fed’s GDPNow reading estimates that Q3 GDP expanded at a 3.4% annualized rate. Job growth remains robust, as evidenced by the September ADP and nonfarm payroll data, both of which came in above consensus. Contrary to manufacturing, services PMIs point to continued growth—having not posted a reading below 50 since February of last year. Put that all together and we get an economic growth picture that is relatively sanguine. Further, given the services component of inflation (unit labor costs, real wages, etc.) we believe that the path to sustained inflation readings of below 2% might be more gradual than expected.

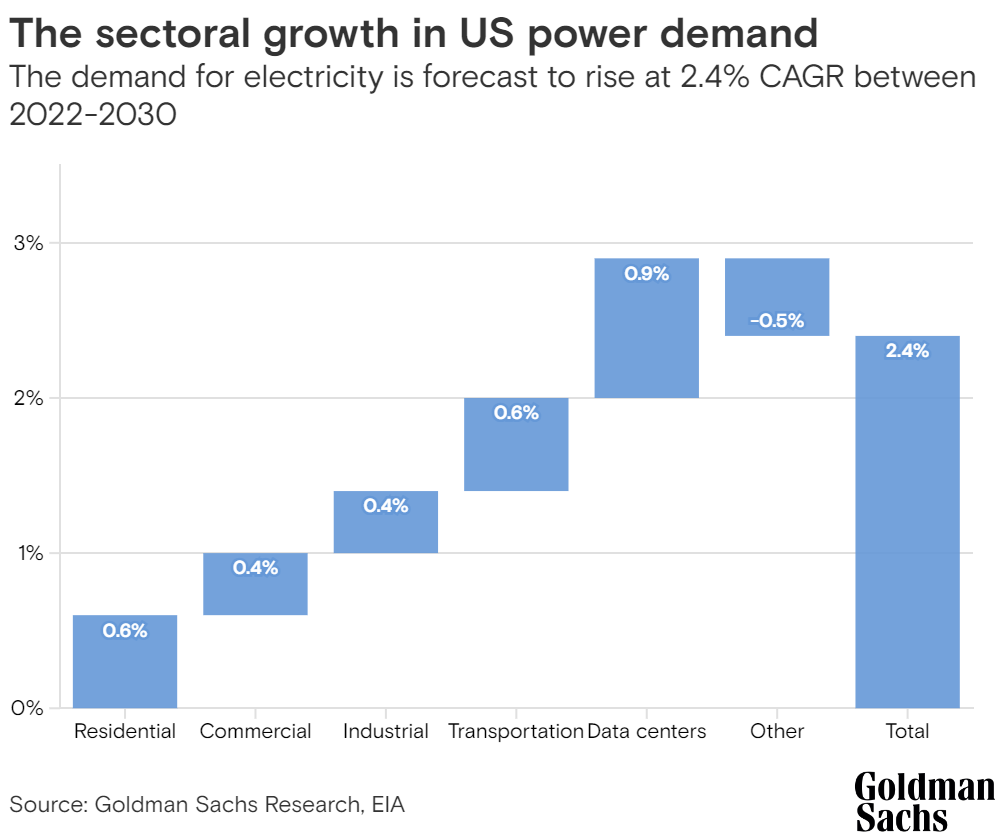

One noteworthy growth factor worth spending time on is the emergence of AI and its impact on projected economic growth. It is both true that the technology is revolutionary and that there is A LOT of hype surrounding its transformative potential. However, the money being spent in this 21st-century arms race is material. Bloomberg recently published an article in which they estimated that Big Tech (MSFT, Amazon, Google, etc.) could collectively spend $200 billion in AI capex in 2025, of which $90B would represent incremental growth vs. 2023—for reference, $90B represents 0.3% of total projected US GDP in 2024. Capex spending of that magnitude and the potential productivity gains resulting from a more deployed AI infrastructure is why firms like PwC are calling AI the “$15.7 trillion game changer”. While it is fun to debate potential, adoption, and applicability, one area in which there appears to be consensus is the demand (and strain) the AI build-out is going to put on our energy infrastructure. The chart below illustrates the forecasted demand contribution represented by data centers.

With all of the major tech companies having made net zero or carbon neutrality commitments, we view the growth in power demand as supportive of our sustainable transition theme. A practical example is the investment one of our private equity managers, Encap Energy Partners, has made in a company called Parliament Solar. One of their most recent development projects, a solar field outside Houston, is projected to generate 640 MwH of clean electricity, of which 97% is contracted to be used by Microsoft’s data centers. This is just one anecdote, but we believe that it reflects the broader opportunity as energy consumption by data centers is projected to grow. When coupling incremental investment spending with the potential for productivity growth, which coincidentally grew at 2.7% over the last 12 months ending in Q2 2024—nicely above the post-WWII average of 2.1%—we see reason for optimism in our long-term economic outlook. At the very least, it is a helpful tailwind to have.

Investment Themes – How to Position Portfolios?

Given the investment themes and the risk factors at play, we believe there are specific considerations and implementation plans for each major asset class:

Fixed Income

We expect returns to be largely yield-oriented, with only modest expectations for capital appreciation, stemming from a shift in interest rate expectations. Interestingly, the yield on the 10-year Treasury is up almost 60bps since the Fed decided to cut its target rate by 50bps. Over the last month, we have seen the probability of three or more rate cuts this year drop from 63% to 0%, according to the CME. We expect this level of uncertainty to persist, which will translate to higher price volatility on a day-to-day and week-to-week basis for our fixed-income managers. Our approach has been to avoid getting cute with duration bets and accept the higher volatility that the data-dependent nature of the Fed’s decision-making process of late implies. The opportunity set we see lies in looking for select distressed or dislocated credit investments. We do so through our flexible-mandate bond managers, as well as through our investments in private credit strategies, such as Oaktree’s Distressed Opportunity Fund which is currently in-market.

Equities

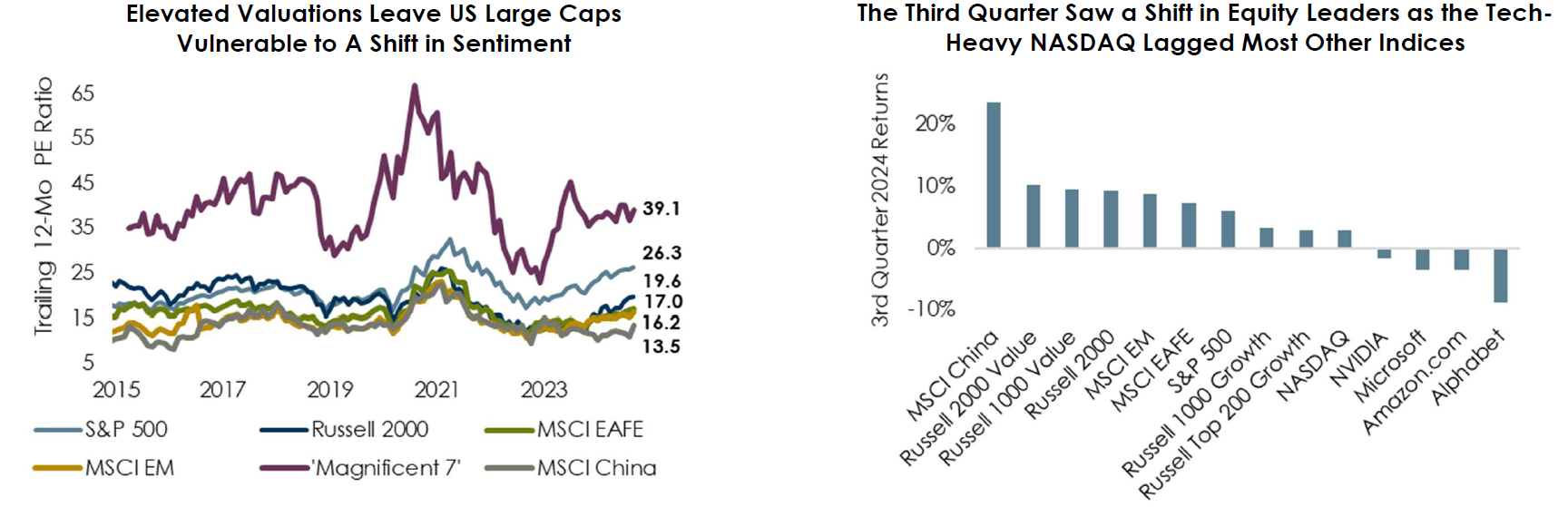

We believe equity markets are currently expensive. As the chart on the left below highlights, market valuations are approaching their prior peaks from 2021. While forward-looking multiples have come down, they are lower in part due to elevated earnings growth expectations for 2025. According to Factset’s most recent earnings insights, analysts expect earnings growth in 2024 to be slightly below 10%, while expecting earnings growth to accelerate to 14.9% in 2025. Despite our investment themes and economic outlook, current valuation levels and earnings growth expectations seem to skew on the optimistic side, in our opinion. We are encouraged, however, to have seen some broadening out of return leaders in Q3 (as highlighted in the chart on the right below). Our philosophy has always been to take a diversified view for sourcing high-quality businesses that range in terms of size and country of domicile. We would not be surprised to see some modest pullback in the market, as earnings growth expectations moderate and we continue to think that current prices support some profit-taking opportunities for those needing to raise cash.

Real Estate

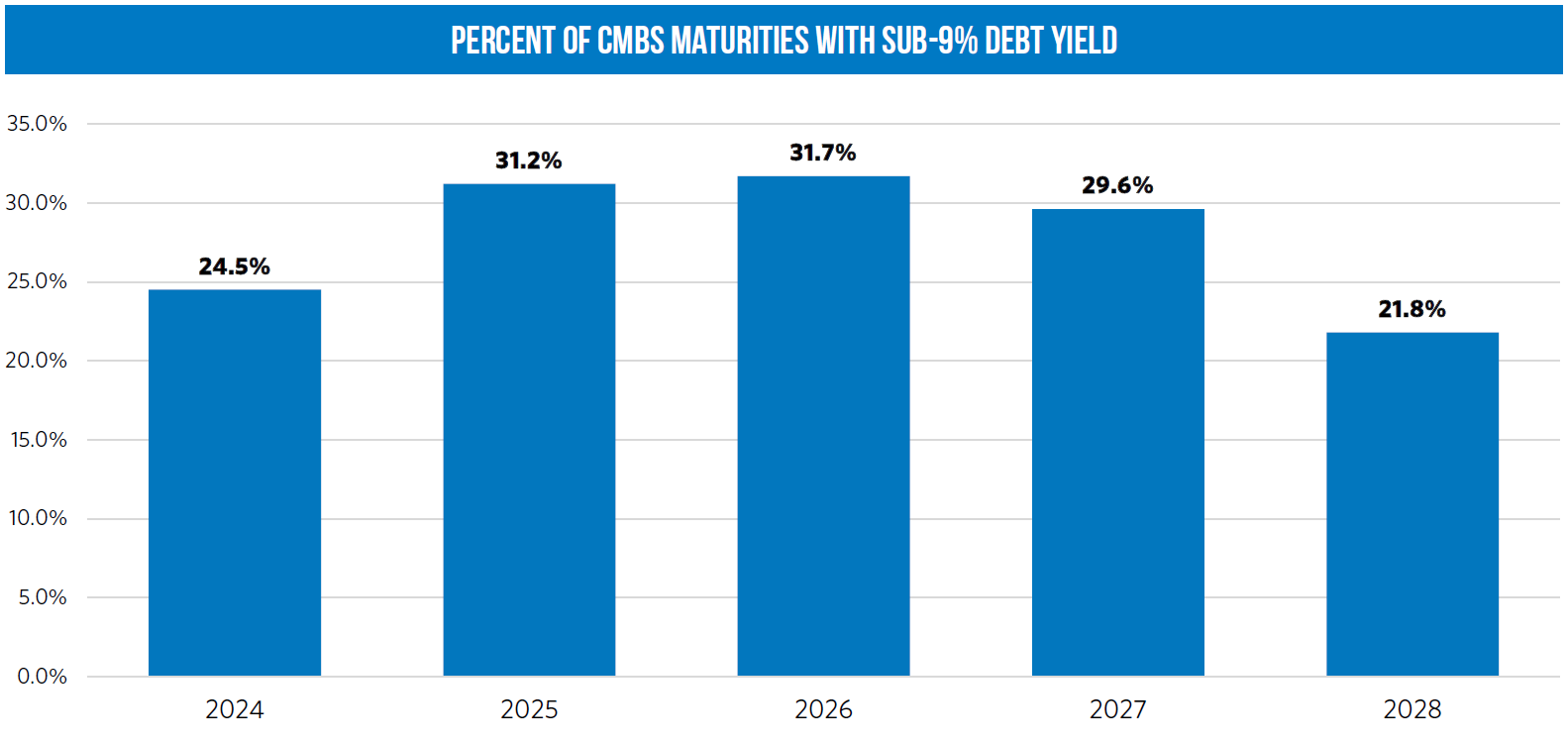

The saga continues in real estate, but we believe the end of many problems is near. That belief is driven by two key factors. The first is that valuation levels have declined to levels where we are starting to see a re-emergence of demand from opportunistic buyers. The second, as the chart below from Starwood indicates, is that there are significant CMBS maturities that will need equity injections in order to provide the ability to refinance.

We believe this creates a compelling distressed and opportunistic real estate investment environment, which funds, like Starwood Capital Group’s Distressed Opportunities Fund XIII, are looking to exploit. Further, to the earlier point regarding AI, one sector that is anticipated to be well represented is data centers and digital infrastructure. Rational valuations and potential distressed investments are leading us to become more and more constructive on the real estate opportunity set.

Investment Themes – The Bottom Line

As we approach the end of the year, we are faced with a complex landscape shaped by competing factors. Despite the uncertainties, our investment themes show portfolios have performed well, with global stocks, real estate, and bonds all posting positive returns. The upcoming US election may add to the noise, yet the focus should remain on long-term goals and seizing opportunities as they arise. Embracing a diversified strategy that focuses on owning high-quality assets, while being prepared for opportunistic investments in longer-term secular trends (like AI infrastructure) and near-term dislocations in credit and real estate are prudent steps. Above all, the end of the year is a time for reflection and planning for the future and we are grateful for the trust our clients place in us to guide them and their families through market complexities and towards a flourishing future.

About Thierry J.D. Brunel

Thierry J.D. Brunel joined Matter in 2013, bringing years of experience in family office and wealth management. He previously worked in investment research and portfolio management roles at Convergent Wealth Advisors and GenSpring Family Office. At Matter, Thierry leads the investment committee, advising families on portfolio strategy and governance. A Wake Forest University graduate, Thierry has a diverse international background. He’s active in his community, serving as an assistant coach for the John Burroughs School Varsity football team in St. Louis.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.