The evolution of blockchain technology and its more fashionable relatives, cryptocurrencies, has been nothing if not fascinating. We’ve watched as the headlines have spanned from an asset with nefarious potential, to a democratizing technology, to a meme-worthy currency alternative. If you ask blockchain disciples, it is “the” technology of the future, whereas skeptics compare it to Dutch tulips or snake oil.

Before we go any further, we should start with a confession: we are not cryptocurrency experts. We are, however, intellectually curious investors, and we have been learning and watching as the market has developed at what seems to be a breakneck speed. For those looking to find definite conclusions in this post, we will sadly disappoint. However, we hope to provide enough insights to further our collective understanding of the risks and opportunities we see in this evolving theme.

Blockchain Technology vs. Cryptocurrency Investments

The concept of blockchain technology finds its roots in the goal of creating a peer-to-peer platform for transacting while protecting and verifying information through a publicly maintained, decentralized, and numeric ledger. Paradoxically, while the ledger is fully public, it provides for the complete anonymity of transacting parties. Further, the public nature of the ledger allows for greater security, as each transaction is independently verified by the network. Compare that to a typical transaction verified by one or two large financial intermediaries. Needless to say, the added security of blockchain technology would appeal in a world in which cyber-security and fraud are a constant threat.

Cryptocurrencies, like Bitcoin and Ethereum, are just unique iterations of blockchain ledgers. Their value (or perception of value—our jury is still out) stems from the overall faith users have in their ability to utilize and transact with their respective cryptocurrencies. The argument could be made that Bitcoin and other cryptocurrencies have proven use in transactions, as numerous businesses now accept payments in cryptocurrencies. A critical unknown, however, is the level and degree of government regulation. In that regard, we are very wary of any concrete conclusions as the range of government intervention has always been wide and unpredictable—particularly when the regulatory target could (and possibly should) be considered a threat to the government’s ability to finance its operations. We cannot underestimate those risks.

To Invest or Not to Invest, That is Quite the Question

Diving a little deeper into the question of cryptocurrencies as investments, we are faced with two fundamental questions:

- How do you assess and assign a valuation to cryptocurrencies?

- What are the real risks and opportunities of investing in cryptocurrencies?

Assigning a Valuation to Cryptocurrencies

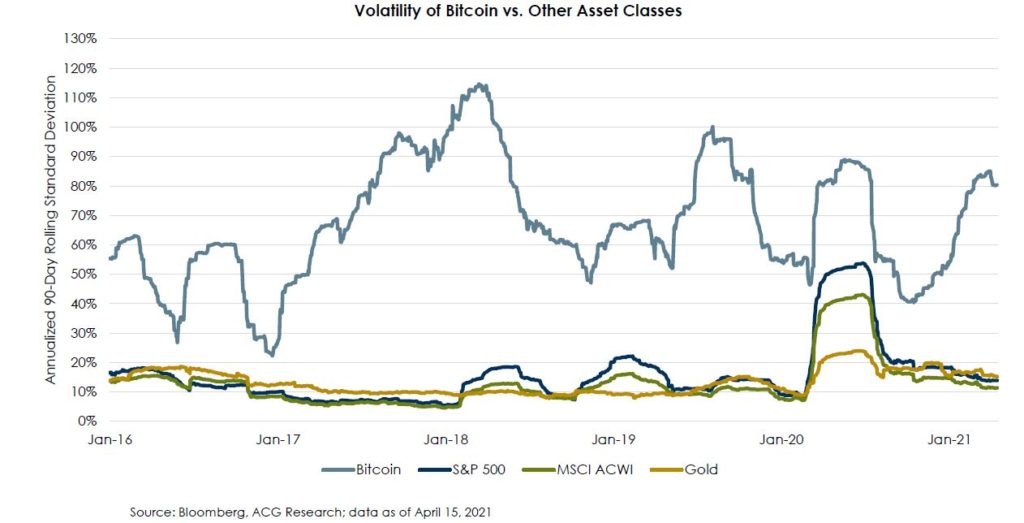

Recent history has shown us that regardless of what valuation any investor assigns to cryptocurrency, the reality is that the market perception of that value has been prone to nauseating swings. The chart below from our colleagues at ACG illustrates the volatility experienced by Bitcoin holders.

Interestingly, the traditional method of valuing a currency has been relative. For example, we only determine the valuation of the Euro when we compare it to the US Dollar or the Japanese Yen or some trade-weighted basket of currencies. We then compare that price to historical norms to determine whether the currency is over or undervalued. While that is an oversimplification (apologies in advance to my college international finance professor) it does outline the basic process. With cryptocurrencies, we have no historical norms, nor is there consensus that they should be valued using traditional metrics. In effect, the finite number of units renders our comparison to fiat currencies—the supply of which can shrink and grow—much more challenging. The bottom line is that we don’t even have a mediocre grasp on how to value crypto; it is much too early.

The Risks and Opportunities of Investing in Cryptocurrencies

Volatility is the most obvious risk. Very few investments have the range of potential values and outcomes as we’ve seen thus far with crypto. Current investors in cryptocurrencies should accept that there is an abnormal risk of complete loss of capital. Disruption, specifically technological disruption, is a double-edged sword. While new technologies carry significant potential, competition is high and so is the risk of obsolescence. In addition, disruption of well-entrenched interests (financial and governmental) can often attract a heavier amount of scrutiny. This article by a manager based in Shanghai highlights the fluidity of the environment and the degree to which governments are motivated to address the issues. In addition, while the value and security of financial intermediaries in our current system of transactions are up for debate, there are some important benefits of a centralized financial system. For example, the role as financial intermediaries supports the deposit bases with those institutions, which in turn supports their lending operations. Is the world really ready for a decentralized lending system in which we are all responsible for underwriting the creditworthiness of all borrowers?

Another risk is the environmental impact of cryptocurrency. Statista estimates that over 65% of the world’s crypto mining is in China which, according to the US Energy Information Agency, derives 58% of its energy from coal. As the world increasingly focuses on combatting climate change, it begs the question: What’s the carbon footprint of cryptocurrencies?

The last risk is one of trust and implementation. As we have seen time and time again, assets and asset classes that are “en vogue” attract both scrupulous and non-scrupulous actors, and differentiating between the two is not always easy. In other words, knowing who and what you are investing in is of the utmost importance. Investing isn’t just about getting the idea right, it is about implementing it correctly as well.

The story is not all risks, however. Blockchain and cryptocurrencies represent a potentially generational disruption opportunity. Similar to the creation of the internet, the move toward digitization (cryptocurrencies, NFTs, smart contracts, etc.) provides enumerable possibilities. While the media focus for now is on cryptocurrencies, an opportunity could exist within the infrastructure and supply chain of digitized assets—crypto-exchanges like Coinbase being one recent example. We believe that as institutional investors like private equity and venture capital firms (see this recent announcement by Andreesen Horowitz) enter the space, the landscape will continue to mature and take shape, allowing investment opportunities to present themselves. As always, the challenge is in differentiating between reality and illusion, and deciding when and how much of a risk to take.

So as promised, we’ve left you with more questions than answers. It’s clear that the opportunity to invest in and around this emerging theme will continue to grow, and we will continue to follow its evolution closely. For now, we remain curious, cautious, and ready to support Matter families in the brave new world of blockchain and crypto.

For those interested in some additional research, this primer by our colleagues at Asset Consulting Group does a good job of outlining some of the basics of blockchain technology and cryptocurrencies.

This report is the confidential work product of Matter Family Office. Unauthorized distribution of this material is strictly prohibited. The information in this report is deemed to be reliable but has not been independently verified. Some of the conclusions in this report are intended to be generalizations. The specific circumstances of an individual’s situation may require advice that is different from that reflected in this report. Furthermore, the advice reflected in this report is based on our opinion, and our opinion may change as new information becomes available. Nothing in this presentation should be construed as an offer to sell or a solicitation of an offer to buy any securities. You should read the prospectus or offering memo before making any investment. You are solely responsible for any decision to invest in a private offering. The investment recommendations contained in this document may not prove to be profitable, and the actual performance of any investment may not be as favorable as the expectations that are expressed in this document. There is no guarantee that the past performance of any investment will continue in the future.